Import Employees - ezPaycheck Payroll Software

Download Now >

Buy Now

With ezPaycheck payroll software, you can add employee one by one manually. You can also import employee basic information from spreadsheet and then edit the employee tax options later.

How to import data from .csv file. How to import data from QuickBooks .iif file How to convert my data from other format to .csv file

If your data is saved in Excel file, you can convert it easily by clicking Excel top menu "File", then click "Save As" to save it as .csv (comma delimited) file.

If you saved data in access, sql server or other database, you can export data to .csv file.

Sample File

For testing purpose, you can download the sample data file here. Then unzip them, extract and save them to your local folder.

https://www.halfpricesoft.com/payroll-software/Employee_data_only.zip

Step 1: Start ezPaycheck payroll software

You can double click the desktop icon to launch ezPaycheck payroll software.

Step 2: Clear employee list (Opional)

If you have test data, please remove it before you import data.

2.1 Click the left menu "Employees" then "List Employee" to view employee list.

2.2 Delete employees.

Step 3: Import employee data

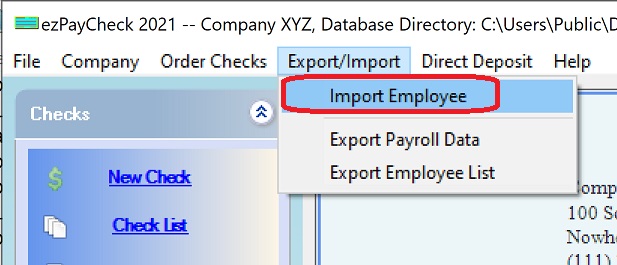

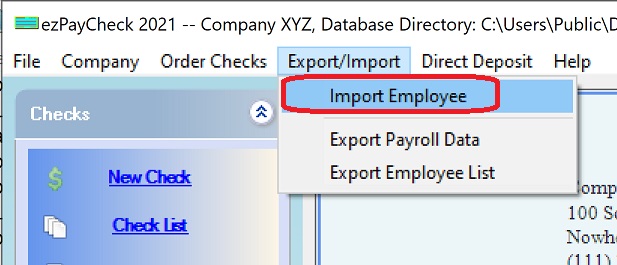

3.1 Click the top menu "Export/Import", then click "Import Employee"

3.2 Select the .csv file.

3.3 Map the fields.

3.4 Click the "Test Parse" button.

3.5 If there is no error, click the "Import" button to save data into database.

Step 4: Refresh Employee List, review and edit the employee tax options.

4.1 Click the left menu "Employees" then "List Employee" to view employee list.

4.2 Select the one employee from list, click "Edit xxxx Record" link to edit employee tax options.

Step 5: Process payroll

Follow

ezPaycheck Quick Start Guide to set up company, edit employees and print paychecks.

Related Links:

ezPaycheck Quick Start Guide How a add a new company account How to handle both employees and contractors How to handle restaurant tips How to add a custom deduction and withhold it from each paycheck automatically How to handle local taxes How to handle State Disability Insurance (SDI) How to print paycheck in different formats: check-on-top, check-in-middle, check-at-bottom or 3-per-page How to print paycheck on blank stock How to print paycheck on pre-printed checks How to print paycheck with company logo How to adjust check printing position Sample Paychecks Determine a Company's Name for e-Filing