|

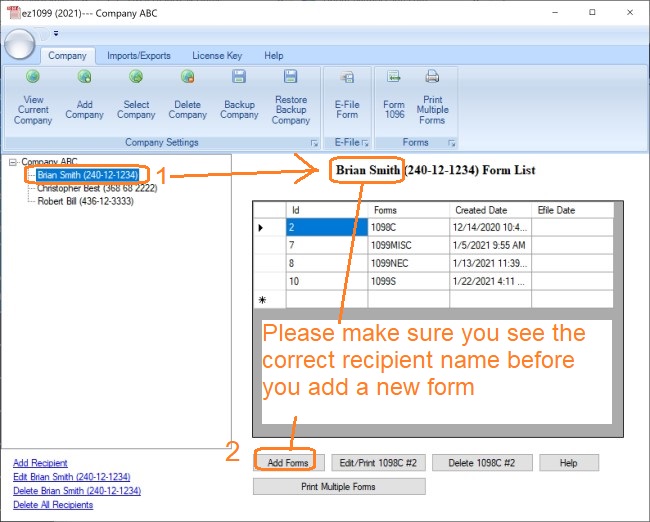

ez1099 software can prepare, print and efile forms 1099 forms (1099A, 1099B, 1099C, 1099CAP, 1099DA, 1099DIV, 1099G, 1099INT, 1099K, 1099LS, 1099LTC, 1099MISC, 1099NEC, 1099OID, 1099PATR, 1099Q, 1099QA, 1099R, 1099S, 1099SA, 1099SB), 1098 forms(1098, 1098C, 1098E, 1098F, 1098Q, 1098T), , 5498 forms (5498, 5498ESA, 5498QA, 5498SA), 3921, 3922, W2G, 1097BTC, and 1096 forms required by the IRS. New ez1099 2025 is available for 2026 tax season! ez1099 2025 now supports the new built-in direct efiling service! |