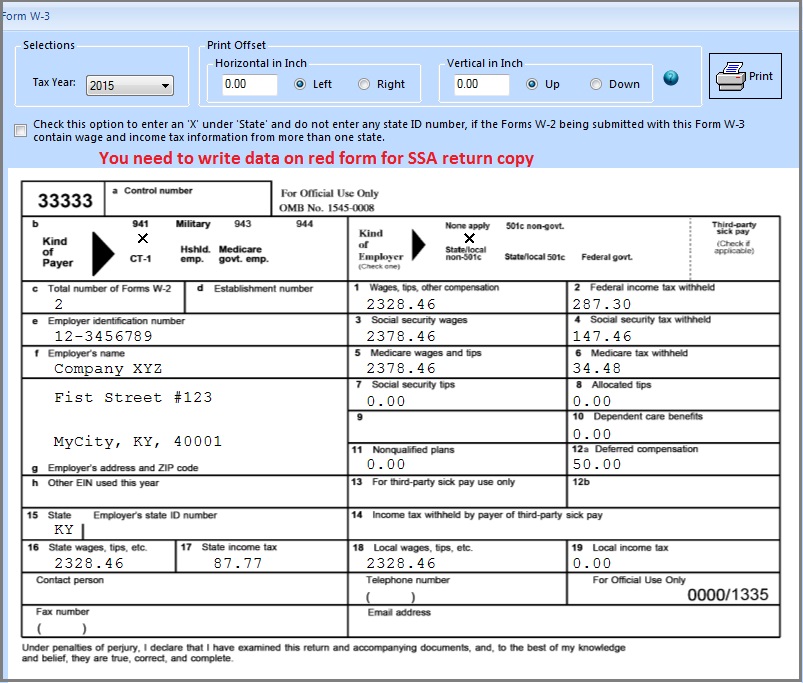

| Desktop Accounting & Payroll SolutionezAccounting software is the right in house accounting solution for small businesses needing to document and report on incoming and outgoing cash flow including sales, receipts, payments and purchases. It also supports payroll processing and tax form printing.Try the ezAccounting free demo - no credit card or obligation required. Limited Time Offer: ezAccounting 2025 & 2026 Bundle |