How to Add a New User to Your IRS ACA Account

This guide walks you through the process of adding a new user to your IRS ACA account, allowing them to file 1095 forms on your behalf. Once the user is added, you’ll need to grant them access to your account for filing purposes.

Need help with filing 1095 forms? Our ez1095 software offers a secure and affordable solution. Check out the ez1095 quick start guide for setup instructions.

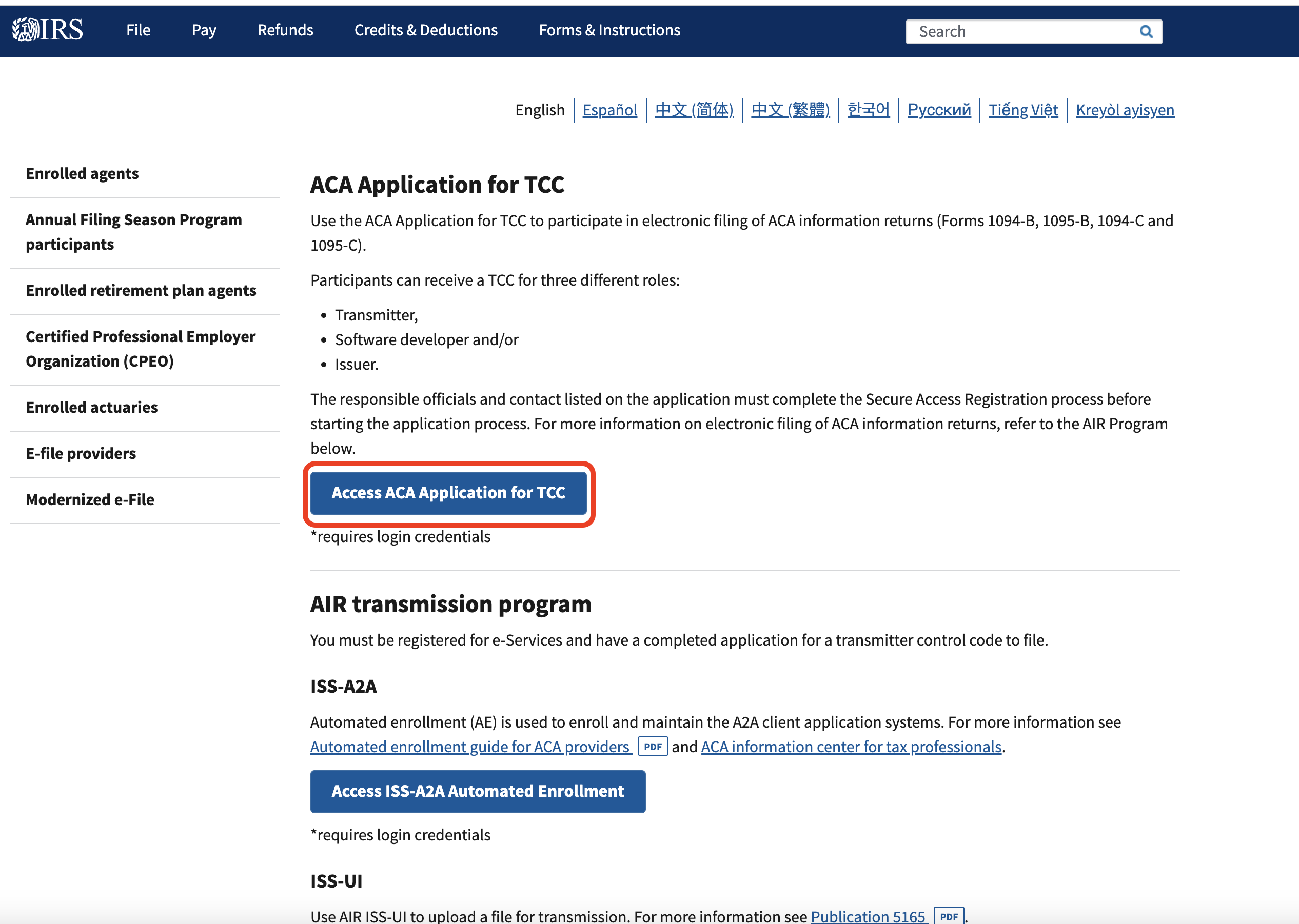

Step 1: Log in to Your IRS ACA Account

Visit the IRS ACA website and log in using your TCC, username, and password. Ensure that you’re logged into your ACA submission account, as the IRS site can be sensitive to the exact URL.

Click the "Access ACA Application for TCC" button to proceed.

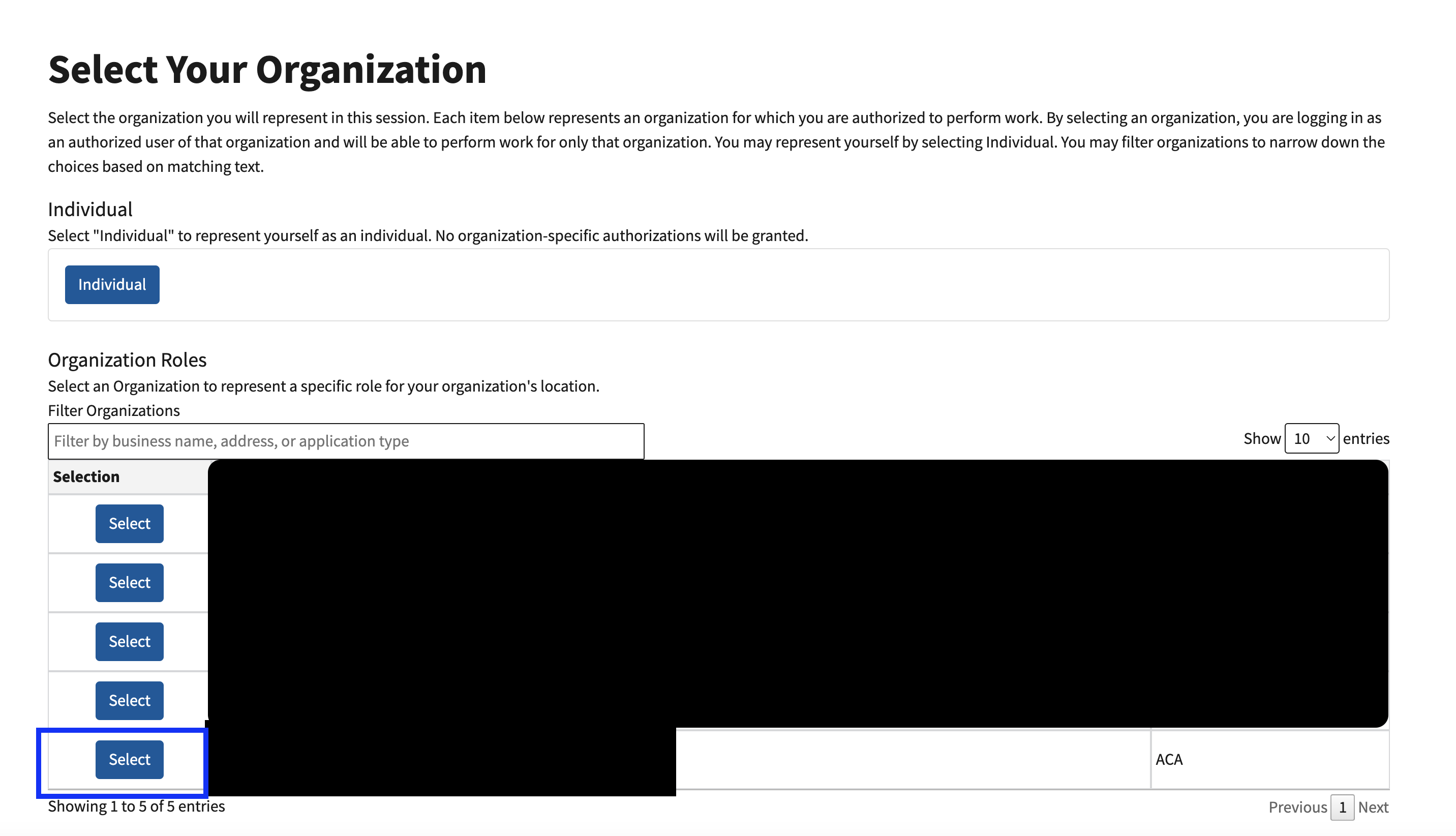

Step 2: Select the ACA Application

After logging in, select the ACA application from the available list.

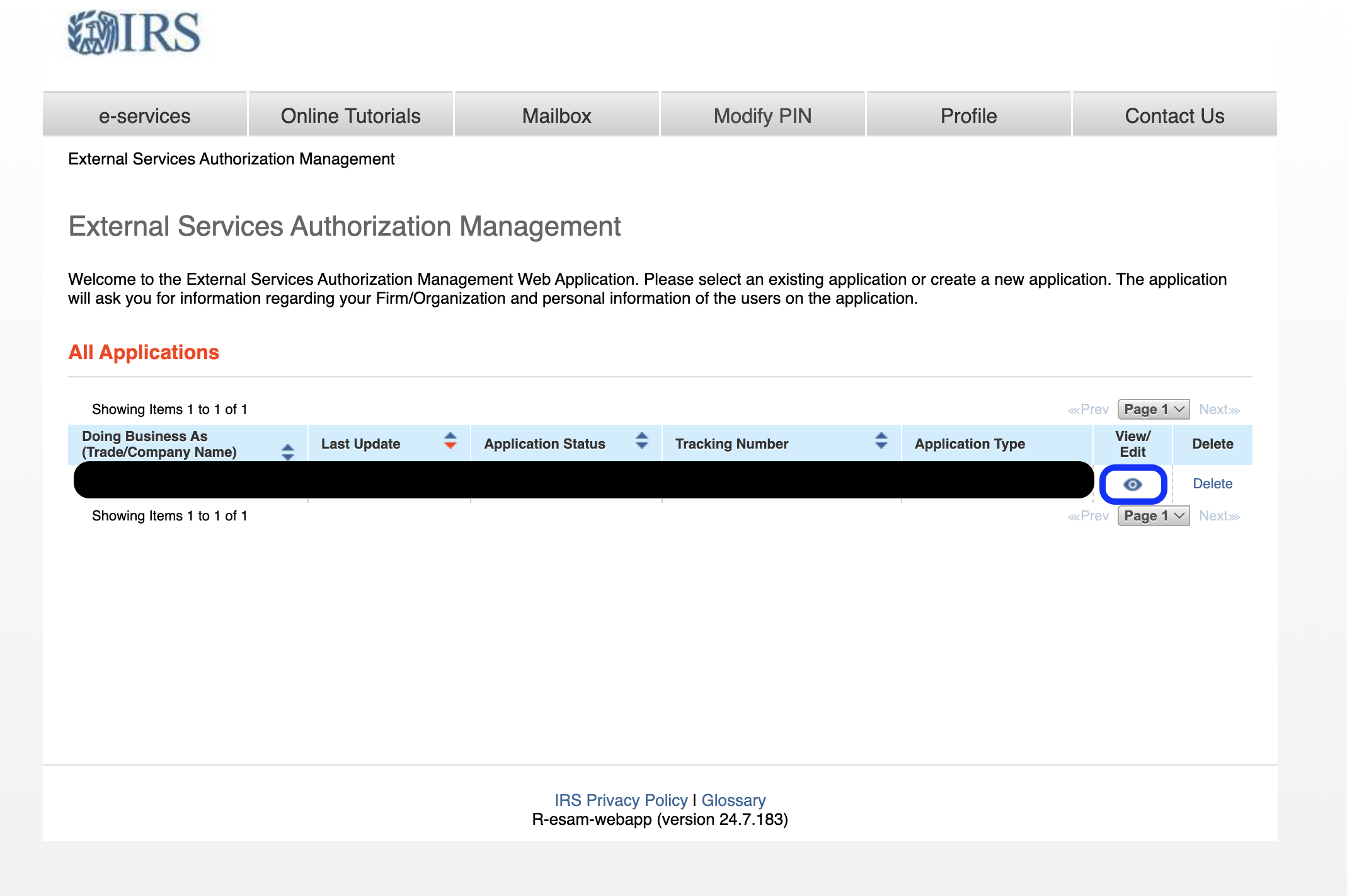

Step 3: Select the TCC Company

Find the TCC Company for which you want to add a new user. Click the "View/Edit" eye button next to it.

Step 4: Access the Authorized Users Tab

In the top navigation bar, click the "Authorized Users" tab to manage users.

Step 5: Add a New User

Click the "Add" button to add a new user. Complete the form with the required information. Since the form requests sensitive information (e.g., SSN), it’s advisable to have the new user complete this section directly.

Step 6: Sign and Submit the Application

Once the new user has been added, you’ll need to sign and submit the application. The new user will receive an email with a link to sign. After they sign, you (and any other account users) must also sign and submit the application.

Your account will be temporarily disabled after submission until the IRS completes its review. This process may take some time, so it’s important to add new users well in advance of any filing deadlines.

Step 7: Generate 1095 Forms

Once approved by the IRS, the new user will have access to your account and can start generating 1095 forms. Consider using ez1095 for an easy and affordable way to generate and file these forms.

If you find any outdated information in this guide, please contact our support team. We work to keep our documentation accurate and up to date.