Direct E-File for W-2 and 1099 is currently available in Beta. This guide will be updated with additional information as it becomes available. If you have any questions or want to use this system, please contact our support team.

What is Direct E-File for W-2 and 1099?

Direct E-File for W-2 and 1099 is a new feature that allows ezPaycheck users to submit Forms W-2, 1099-MISC, and 1099-NEC by uploading them to our website portal. We will then submit the forms directly to the SSA on your behalf. This feature eliminates the need to mail documents or obtain e-file approval from the SSA.

How Does It Work?

-

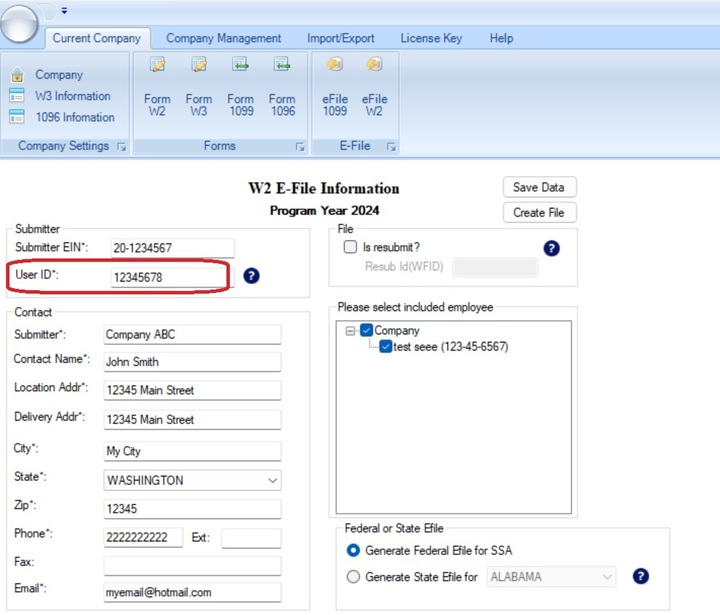

Prepare Forms: Prepare your W-2 and 1099 forms as you normally would in ezW2. After completing your company information in the settings, fill out the transmission information in the e-file settings page as follows:

Halfpricesoft will not verify the validity of your information and will only transmit the information as is. Please ensure the information is correct before submitting.

More detailed preparation instructions can be found here: How to Prepare W-2 and 1099 Forms

warningEnsure the company information entered in the settings is accurate when generating the W-2 and 1099 forms. Use the dummy information only when filling out the transmitter information after clicking the e-File W-2 option.

-

Submit Forms: Once your forms are ready, submit them directly through the web portal. Access the portal here: Submit Forms

-

Monitor Status: Track the status of your submissions through the web dashboard here: Monitor Status