Payroll and Accounting Guides

ezPaycheck Guide

ezPaycheck Mac Guide

ezPaycheck Features

Payroll by State

E-File 941 Guide

ezAccounting Guide

|

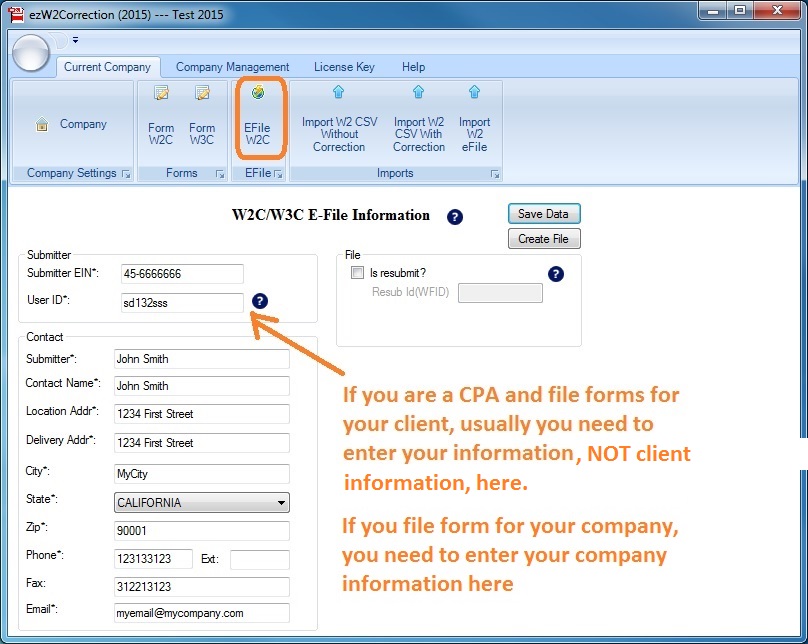

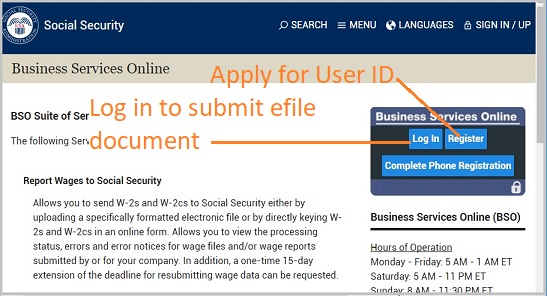

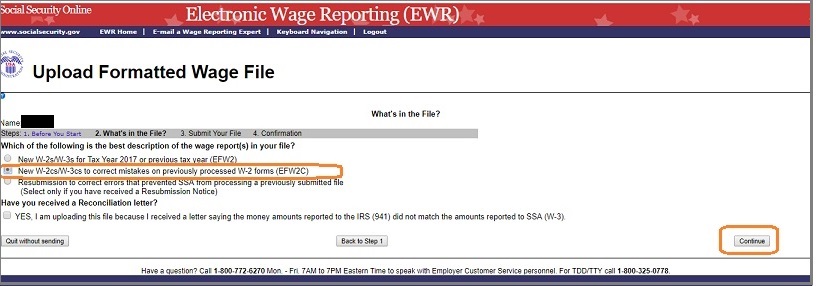

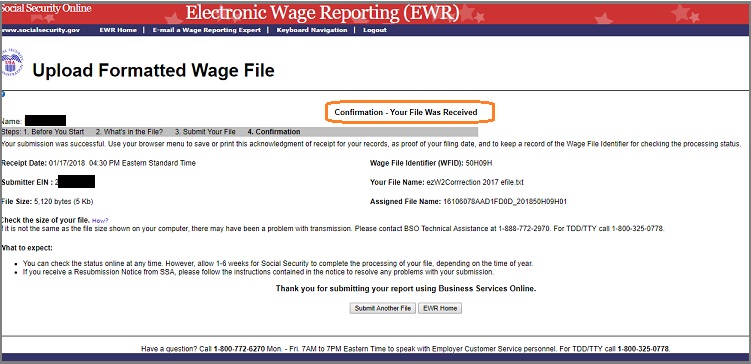

With ezW2Correction, you can paper print, PDF print and efile W-2C and W-3C forms for the previous 10 years. The white paper printing and data import features can save you valuable time and money. Please feel free to test drive ezW2Correction demo version for free before purchasing with no registration needed and no obligation. You can follow the step by step online instructions to finish the installation in minutes ezW2Correction software is compatible with Windows 11, 10, 8.1, 8, 7, 2003 Vista and other Windows computers. |