Payroll and Accounting Guides

ezPaycheck Guide

ezPaycheck Mac Guide

ezPaycheck Features

Payroll by State

E-File 941 Guide

ezAccounting Guide

|

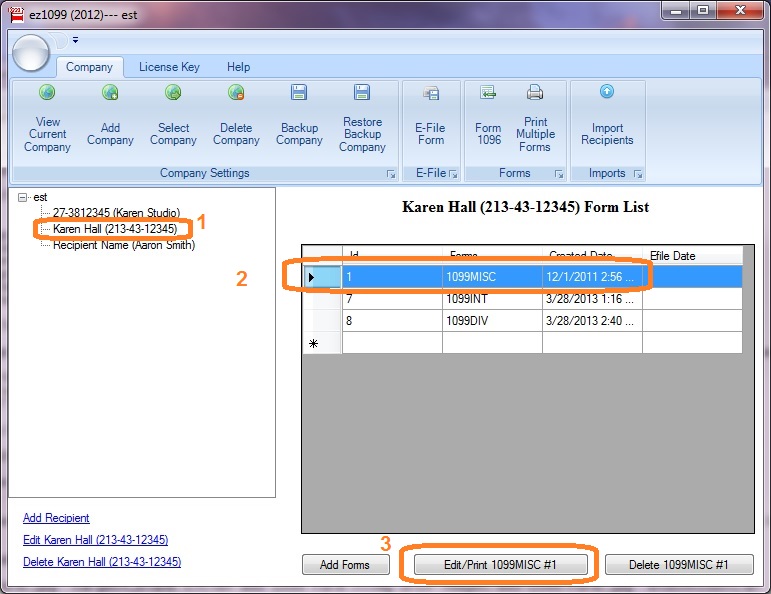

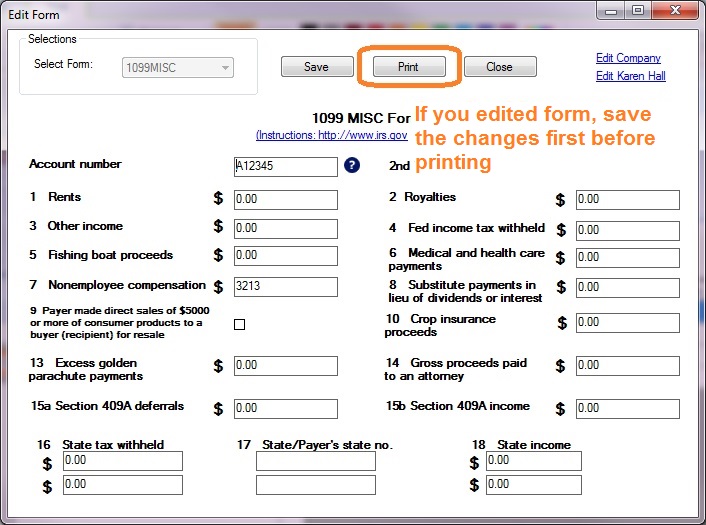

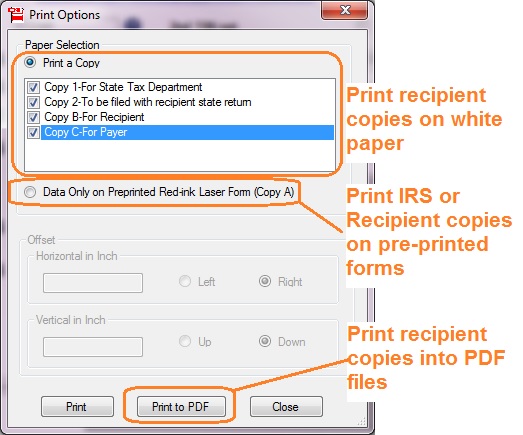

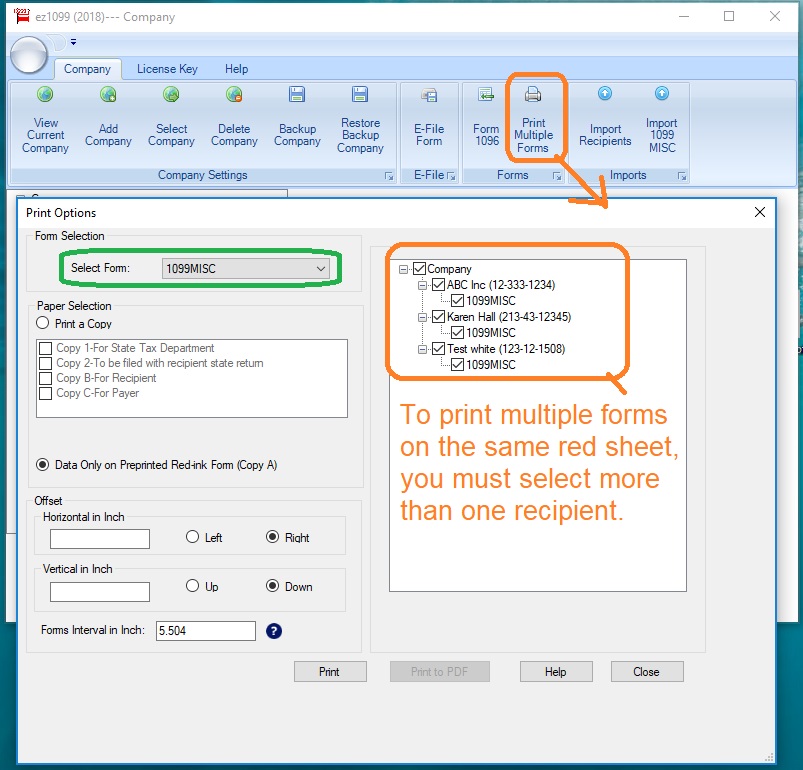

ez1099 software can prepare, print and efile forms W2G, 1097BTC, 1098s (1098, 1098C, 1098E, 1098F, 1098Q, 1098T), 1099s (1099A, 1099B, 1099C, 1099CAP, 1099DIV, 1099G, 1099INT, 1099K, 1099LTC, 1099MISC, 1099NEC, 1099OID, 1099PATR, 1099Q, 1099QA, 1099R, 1099S, 1099SB, 1099SA), 5498s(5498, 5498ESA, 5498QA, 5498SA), 8935, 3921, 3922, 1096 forms required by the IRS. New ez1099 2024 is available for 2025 tax season! If you do not have ez1099 software installed, try it free today with no obligation and no cost. |