Payroll and Accounting Guides

ezPaycheck Guide

ezPaycheck Mac Guide

ezPaycheck Features

Payroll by State

E-File 941 Guide

ezAccounting Guide

The e-filing 941 feature, available as a recommended add-on, enables users to submit Form 941 directly through the application, eliminating the need to mail documents or navigate the IRS website.

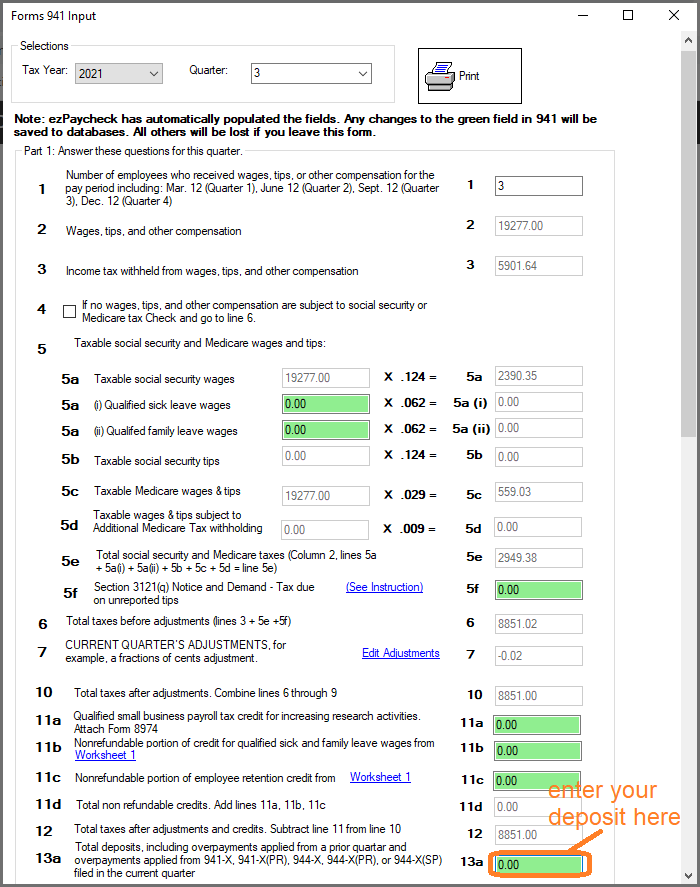

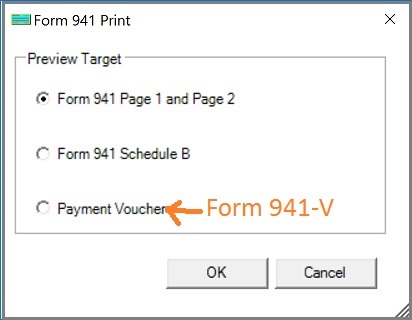

How to efile 941 form - step by step guide

|

ezAccounting software is the right in house accounting solution for small businesses needing to document and report on incoming and outgoing cash flow including sales, receipts, payments and purchases. It also supports payroll processing and tax form printing. If you have not installed this software, you can download and try it free with no obligation and no credit card needed. This accounting software is compatible with Windows 11, 10, 8, 7, Vista and other Windows computers. ezAccounting makes it easy to track income and cost! |