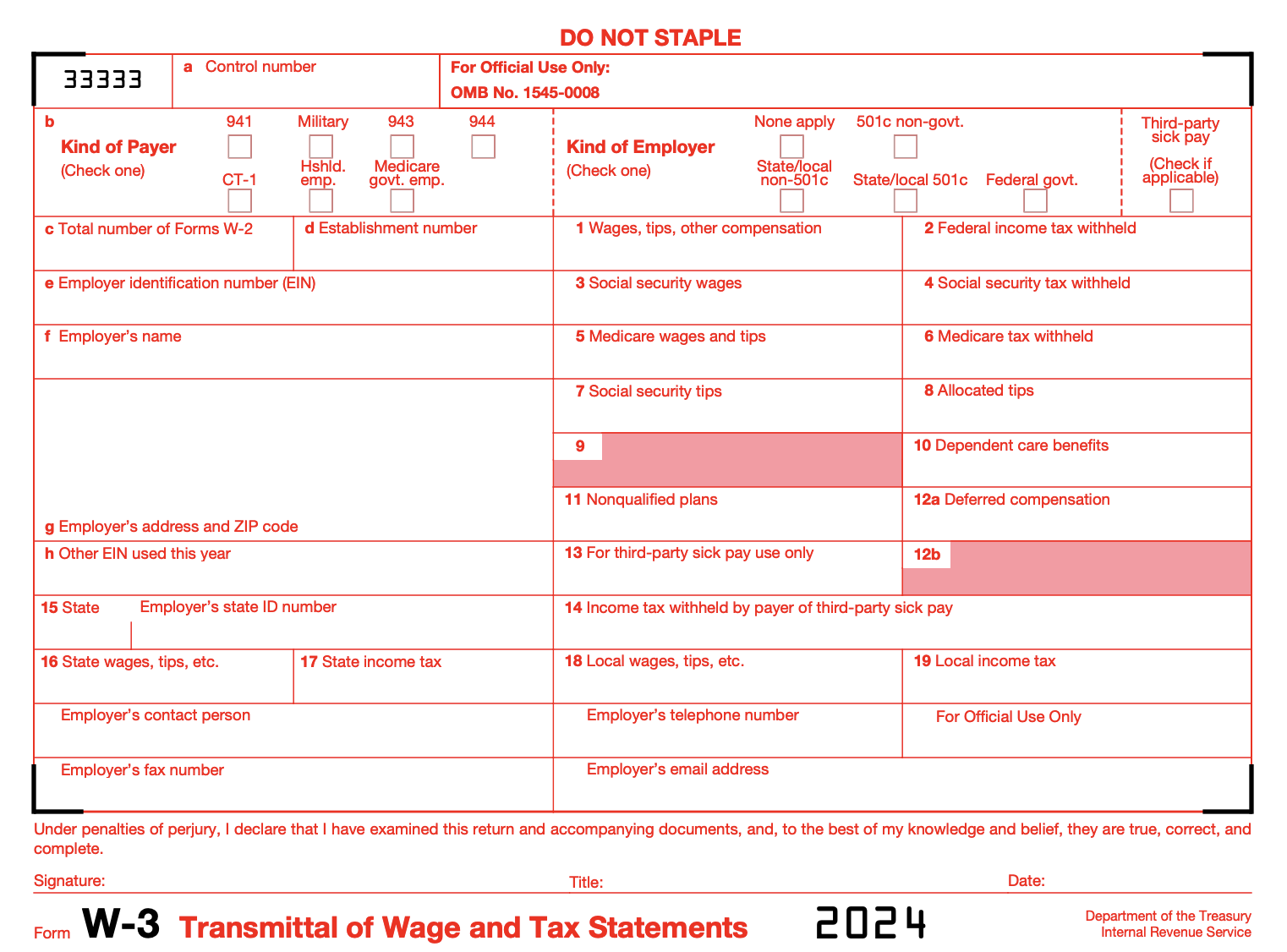

The W-3 form, officially known as the "Transmittal of Wage and Tax Statements," is a summary tax form that employers in the United States are required to file along with their W-2 forms. The W-2 forms report wages paid to employees and the taxes withheld throughout the year, while the W-3 form acts as a cover sheet that summarizes the total earnings, Social Security wages, Medicare wages, and tax withholdings for all employees.

The W-3 form is submitted to the Social Security Administration (SSA) and is used to verify the accuracy and completeness of the W-2 forms provided by the employer. It consolidates the information from all the W-2 forms and provides a comprehensive summary of the employer's annual payroll activities.

Most companies in the US track and file this information with software like ezPaycheck. Payroll software like ezPaycheck is the most effecient way for employers to maintain accurate records while also ensuring compliance with IRS and SSA requirements. Additionally, employers can simultaneously file W-2 Forms.

Why is the W-3 Form Important for Employers?

1. Legal Compliance:

IRS Requirements: Filing the W-3 form is a legal requirement for employers. The Internal Revenue Service (IRS) mandates that employers submit this form along with the W-2 forms to ensure accurate reporting of wages and taxes.

Avoiding Penalties: Failure to file the W-3 form on time or accurately can result in significant penalties and fines. Employers must comply with these regulations to avoid legal and financial repercussions.

2. Accuracy and Verification:

Data Accuracy: The W-3 form serves as a verification tool for the SSA. It ensures that the total wages and taxes reported on individual W-2 forms match the aggregate amounts on the W-3 form.

Audit Preparedness: Accurate and consistent reporting helps employers maintain clear records, which are crucial in the event of an IRS audit. The W-3 form provides a consolidated summary that can be used to cross-check and verify payroll data.

3. Employee Benefits:

Social Security and Medicare: The information on the W-3 form is used by the SSA to calculate employees' eligibility for Social Security benefits and Medicare. Accurate reporting ensures that employees receive the correct benefits based on their earnings and contributions.

Trust and Transparency: By ensuring accurate reporting and timely filing of tax forms, employers build trust and transparency with their employees. This can lead to increased employee satisfaction and loyalty.

4. Record-Keeping:

Centralized Information: The W-3 form provides a centralized summary of payroll data for the entire year. This makes it easier for employers to maintain and reference records as needed.

Historical Data: Employers can use the W-3 form to review and analyze historical payroll data, helping them make informed decisions about future payroll practices and compliance.

5. Simplified Filing Process:

Electronic Filing: The SSA encourages electronic filing of W-2 and W-3 forms, which simplifies the submission process and reduces the likelihood of errors. Electronic filing also ensures faster processing and confirmation of receipt.

Streamlined Workflow: Using payroll software that supports electronic filing of W-2 and W-3 forms can streamline the entire payroll process, saving time and reducing administrative burdens for employers.

Relevant Deadlines

Employers must file W-2 forms to the SSA and provide copies to employees by January 31st in order to not face penalities. This deadline is for both electronic and paper filings.