Handling the logistics of managing employees is essential to any small business.

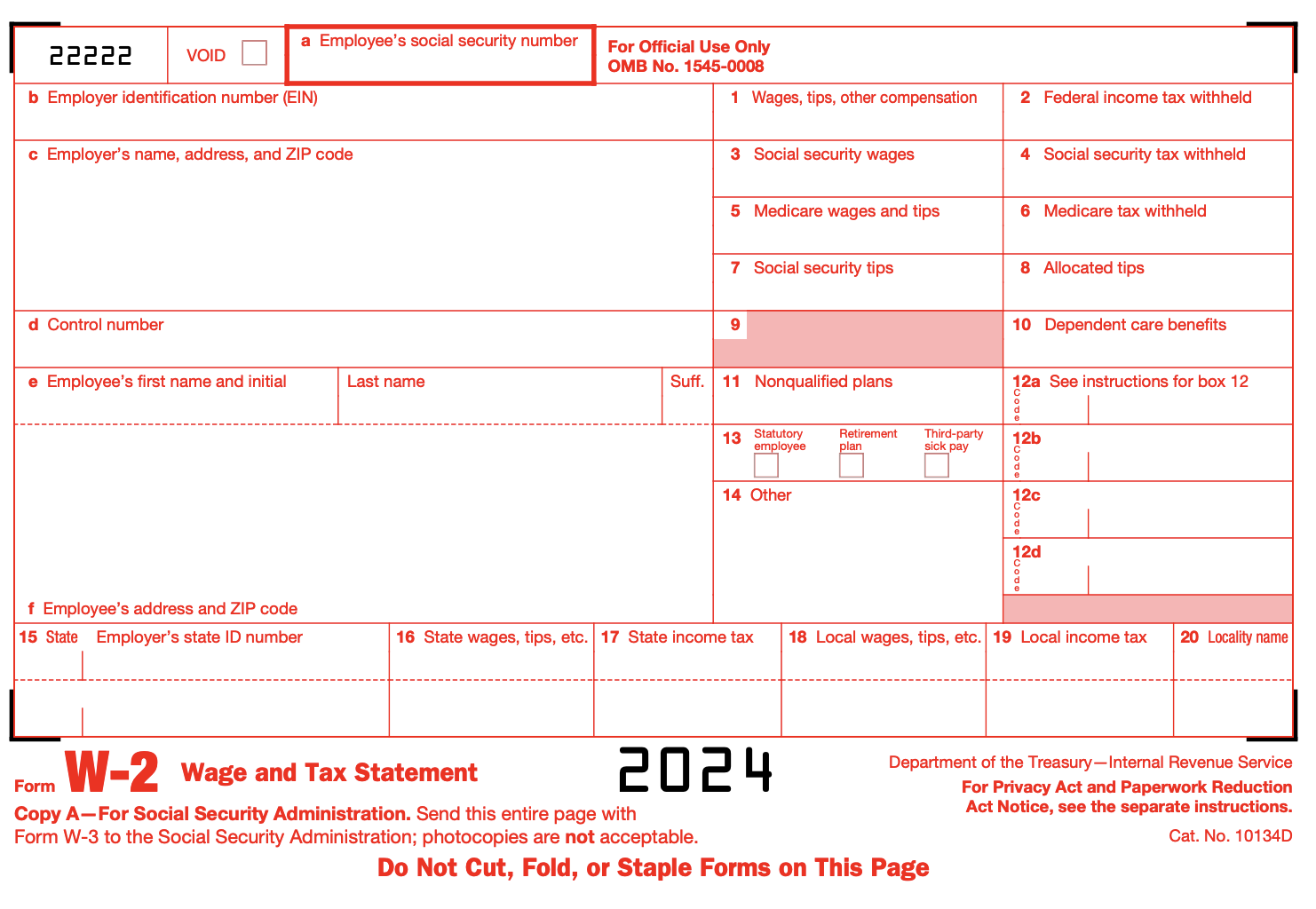

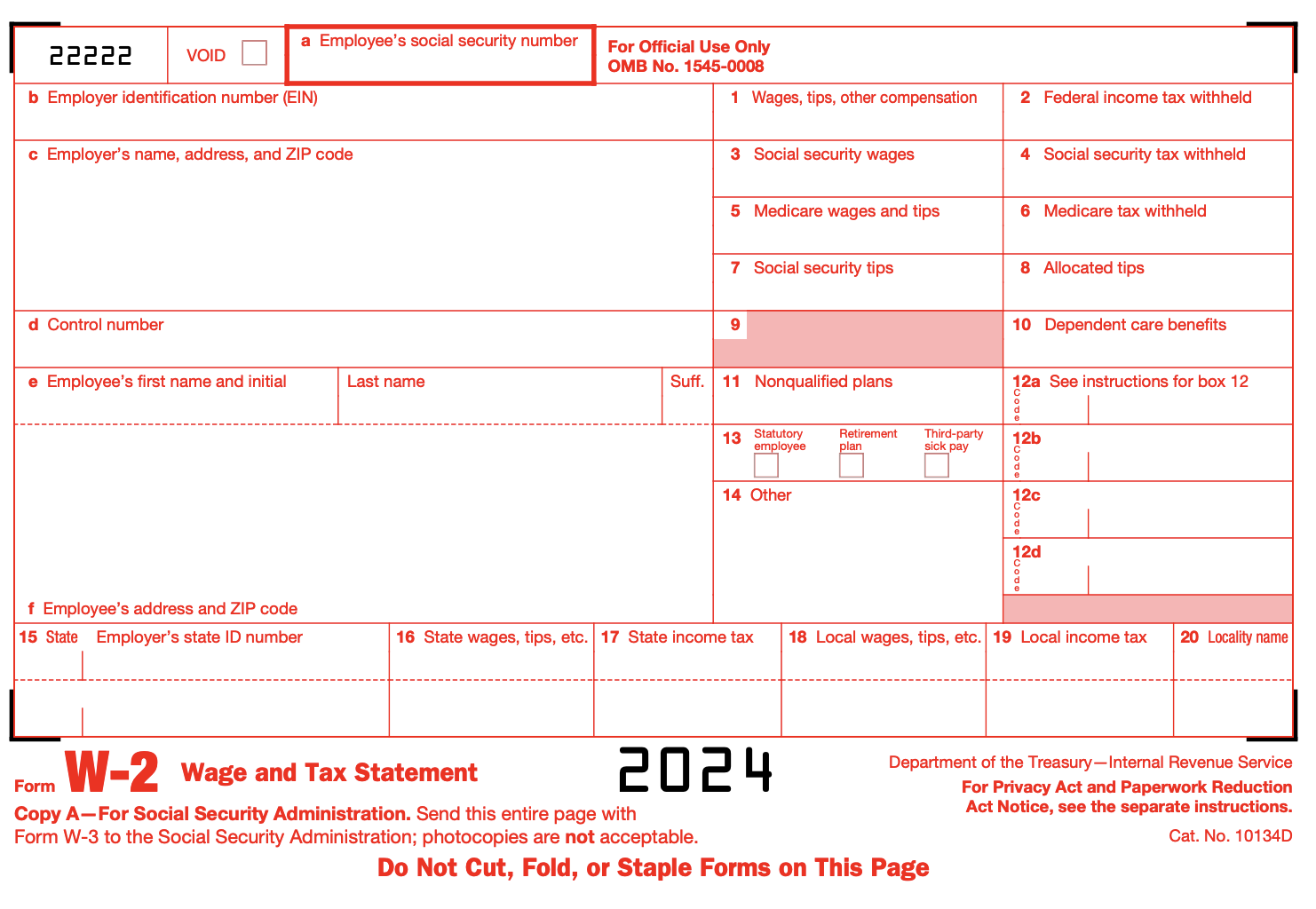

The W-2 form, officially known as the "Wage and Tax Statement," is a critical document used in the United States for tax reporting. It is an IRS tax form that employers must complete and distribute to their employees and the Social Security Administration (SSA) at the end of each tax year.

Employers are required to file this alongside a W-3 Form.

The W-2 form reports the wages paid to employees and the taxes withheld from their paychecks. It includes detailed information such as:

- Employee's total annual earnings.

- Federal, state, and other taxes withheld.

- Social Security and Medicare contributions.

- Additional information about benefits such as retirement plans and health insurance.

Most companies in the US track and file this information with software like ezPaycheck. Payroll software like ezPaycheck is the most effecient way for employers to maintain accurate records while also ensuring compliance with IRS and SSA

requirements. Additionally, employers can simultaneously file W-3 Forms.

Why Do Businesses Need to File W-2 Forms?

1. Legal Requirement:

Compliance with IRS Regulations: Employers are legally required to file W-2 forms for each employee to comply with IRS regulations. Failure to do so can result in penalties and fines.

Employee Obligations: Employees need W-2 forms to accurately file their income tax returns. It ensures that they report their earnings and tax withholdings correctly.

2. Accurate Tax Reporting:

Employer Responsibility: The W-2 form helps ensure that employers are accurately reporting the wages they have paid and the taxes they have withheld. This is crucial for maintaining transparency and integrity in financial reporting.

Audit Preparedness: Accurate W-2 filings can protect businesses during IRS audits by providing a clear record of wages and tax withholdings.

3. Social Security and Medicare Contributions:

Contribution Tracking: The W-2 form is used by the SSA to track an employee's earnings throughout their working life, which determines their eligibility for Social Security benefits and the amount they will receive upon retirement.

Medicare Eligibility: It also helps in calculating the contributions towards Medicare, ensuring employees receive medical benefits when eligible.

4. State and Local Tax Compliance:

State Tax Requirements: Many states require W-2 forms for state income tax filing. Employers must comply with these requirements to avoid state-level penalties.

Local Taxes: In some jurisdictions, local taxes also need to be reported through the W-2 form, making it essential for businesses operating in those areas.

5. Employee Benefits Administration:

Retirement Plans and Health Insurance: W-2 forms often include information about employee contributions to retirement plans (such as 401(k)) and health insurance premiums. This helps both employers and employees manage these benefits effectively.

Relevant Deadlines

Employers must file W-2 forms to the SSA and provide copies to employees by January 31st in order to not face penalities. This deadline is for both electronic and paper filings.

An example of the first page of a W-2 from from 2024.

The Filing Process

1. Tracking Payroll Information for the W-2:

Employers need to track payroll information for employees. Most employers opt to track this information using software in order to better track past payments.

In order to best track this information, ezPaycheck is perfect for most companies. The software designed for small and medium sized companies that are beginning to file payroll or trying to digitize their systems.

2. Distributing the W-2:

Employers must provide copies of the W-2 to their employees by January 31st of the following year. Copies must also be sent to the SSA, typically by the end of February if filing electronically.

Like mentioned above, ezPaycheck can also offer this capability. Alternatively, ezW2 also can offer printing capabilities.

3. Electronic Filing:

Many employers choose to file W-2 forms electronically through the SSA's Business Services Online (BSO) portal. This method is efficient, reduces paperwork, and ensures timely submission.

More instructions on how to do this can be found here.

Form Types

There are several types of W-2 forms, each designated for different purposes:

- W-2 Copy A: Submitted to the SSA. (In addition to a W3 form).

- W-2 Copy B: Provided to the employee for federal tax filing.

- W-2 Copy C: Employee's copy for their records.

- W-2 Copy D: Employer's copy for their records.

- W-2 Copy 1: Submitted to the state, city, or local tax department.

- W-2 Copy 2: Employee's copy for state, city, or local tax filing.

Common Mistakes to Avoid

When filing W-2 forms, employers should be aware of common mistakes that can lead to penalties and compliance issues:

- Incorrect Employee Information: Ensure that employee names, Social Security numbers, and other details are accurate and up-to-date.

- Missing Deadlines: Failing to file W-2 forms by the deadline can result in penalties.

- Math Errors: Mistaken caculations can lead to penalties. These can be best avoided by using software like ezPaycheck.

- Failure to Distribute Copies: Employees must receive their W-2 forms by the deadline to file their taxes accurately.

-

Forgetting to file W-3 Forms: Employers are also required to file W-3 forms alongside W-2s

Consequences of Non-Compliance

Failing to file W-2 forms on time or accurately can result in severe consequences for businesses, including:

- Financial Penalties: The IRS imposes fines for late or incorrect filings. These penalties increase the longer the delay.

- Legal Issues: Persistent non-compliance can lead to legal action against the business.

- Employee Dissatisfaction: Employees rely on W-2 forms for their tax filings. Delays or errors can cause frustration and financial inconvenience for them.

Conclusion

Filing W-2 forms is a fundamental responsibility for businesses. It ensures compliance with federal and state tax laws, supports accurate employee benefit tracking, and helps maintain the financial integrity of the business. By understanding the importance of the W-2 form and adhering to

filing requirements, businesses can avoid penalties, support their employees, and contribute to the overall economic health of the country.

Due to the difficulty of tracking this information filing the forms correctly, using payroll software like ezPaycheck is the best way to remain in complaince with IRS and SSA requirements.

Related Articles and Useful Links