How to Calculate 2025 Federal Income Withhold Manually

ezPaycheck payroll software speeds up and simplifies payroll tax calculation, paycheck printing and tax reporting for small businesses. However if you like to calculate the taxes manually, you can find the step by step guide below.

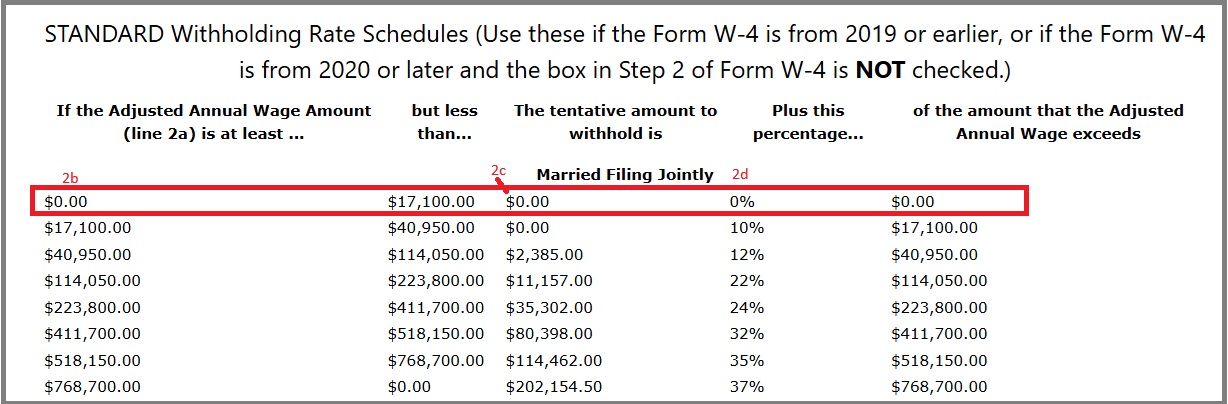

Follow the steps in this sample if employee submitted 2020 and later W4 Form Example: John, married filling jointly, 2022 W4 form, semimonthly pay period, gross pay 1208.63 per paycheck.