How to eFile 1095/1094 Forms to State

(Click here to view

How to efile ACA forms to IRS )

Try ez1095 now

ez1095 software can generate the XML documents you can upload to IRS site and state.

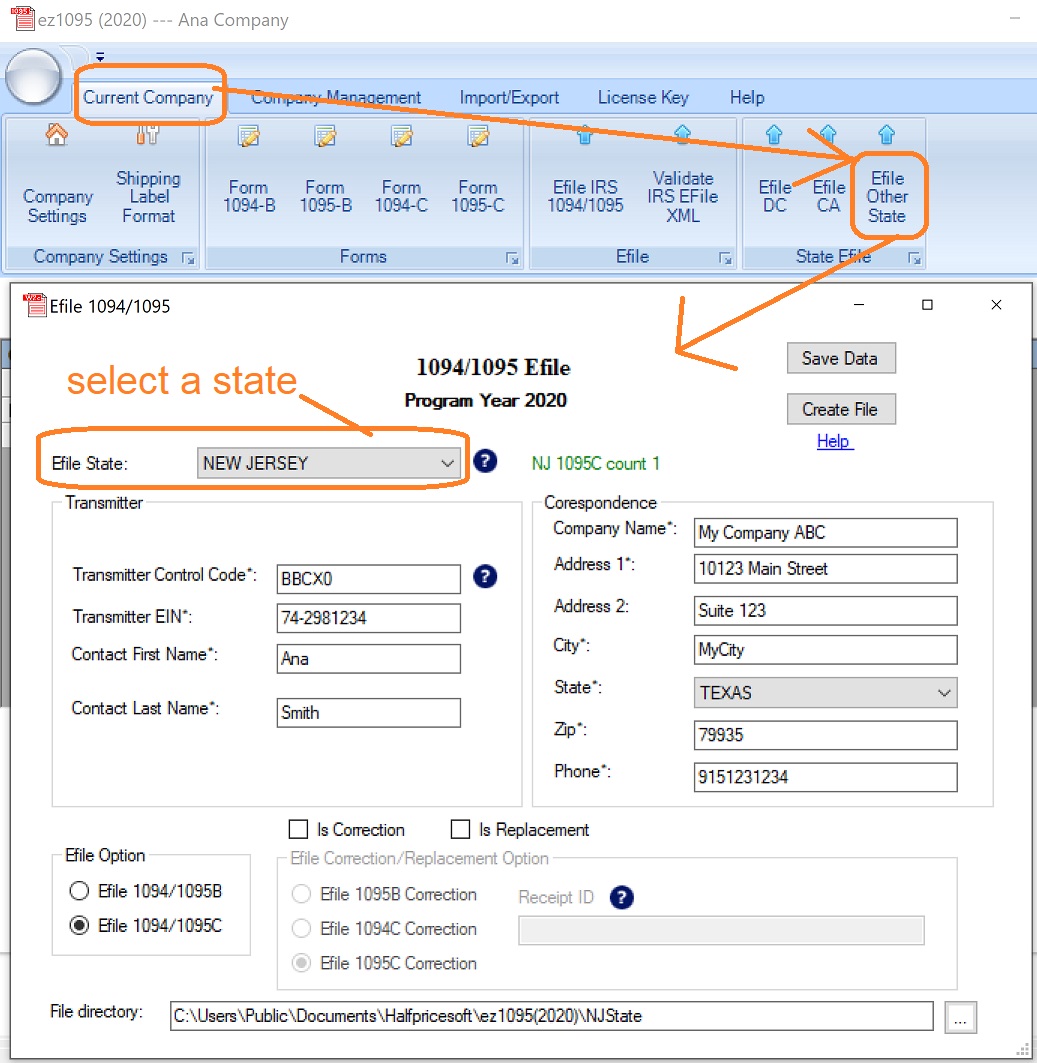

2. If your state accepts the federal format efile document, you can send the same IRS document to your state.

For example:

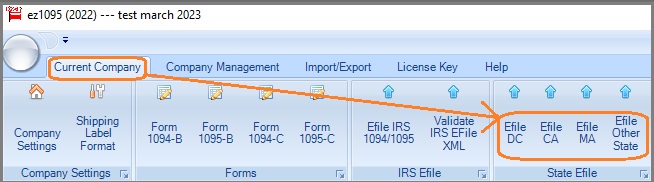

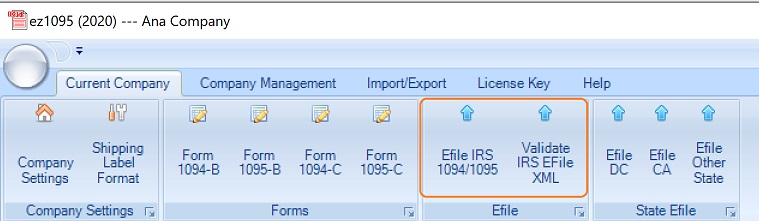

New Jersey (NJ) state will accept the IRS format XML files.2.1 If you want to include all your 1095 forms in your efile document, please use the "Efile IRS 1094/1095" feature and follow the guide to generate the efile for IRS.

How to generate IRS efile document

https://www.halfpricesoft.com/aca-1095/how-to-efile-1095-step-by-step-guide.asp

2.2 If you want to include 1095 forms with employee address in one state only, please use the "efile Other State" feature.

Try ez1095 now Related Links

How to prepare, print and e-file Form 1094/1095-C and 1094/1095-B?

(Regular submissions, corrections, and replacements for both current and prior years, for both IRS and state agencies)

How to File 1095 ACA Forms Electronically to the IRS without a TCC? How to import data? Data sharing (for multiple-user version)? How to pass ACA Testing (for new e-filers)? How to validate XML files before submitting to IRS? Steps to take if the ACA form submission is rejected or accepted with errors Other Forms

How to print and efile form W-2? How to print and efile form 1099-nec? How to file form 1099-misc, nec, div, oid and more?