Step 7: Upload files to IRS site

If you've just obtained your TCC today, it's wise to hold off on conducting ACA testing immediately. Allow 1 to 2 business days for the IRS servers to recognize and synchronize with your new TCC status.

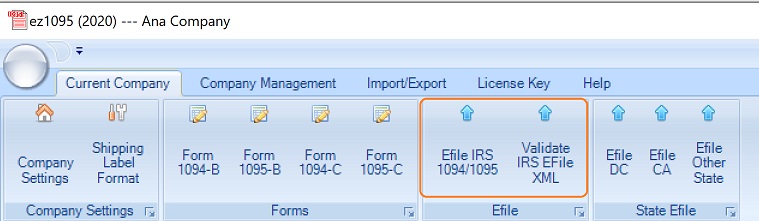

After you click the "Create File" button, two new XML files will be created in the file folder. (Note: You can view the file folder path at the bottom of the ez1095 efile screen.)

You need to upload these two XML files to IRS:

"Manifest_soapheader_xxxxxx.xml"- this is the manifest file "1094X_Request_YourTCC_xxxxx.xml"- this is the data file PLEASE DO NOT MODIFY FILES. Please record the Receipt ID after uploading.

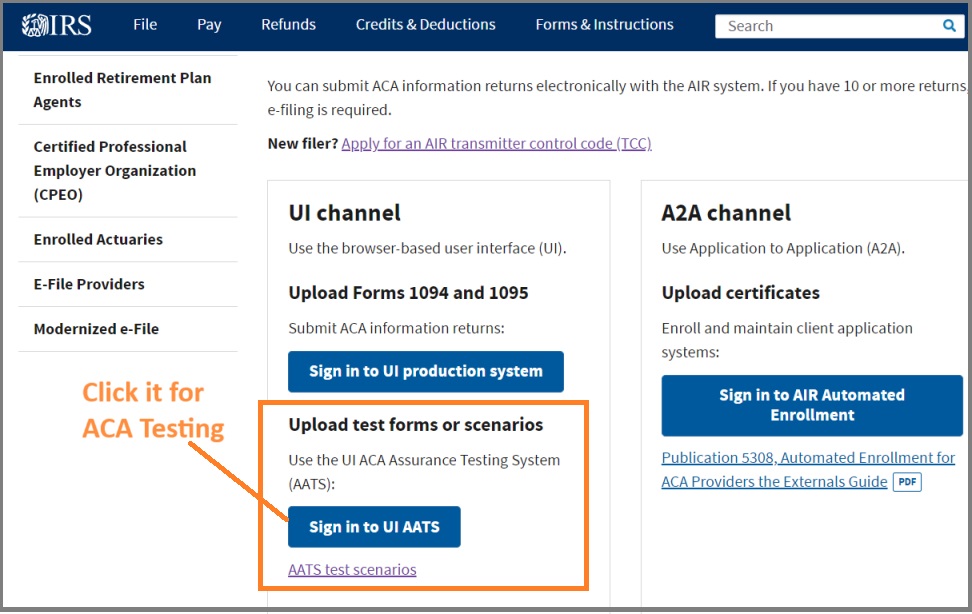

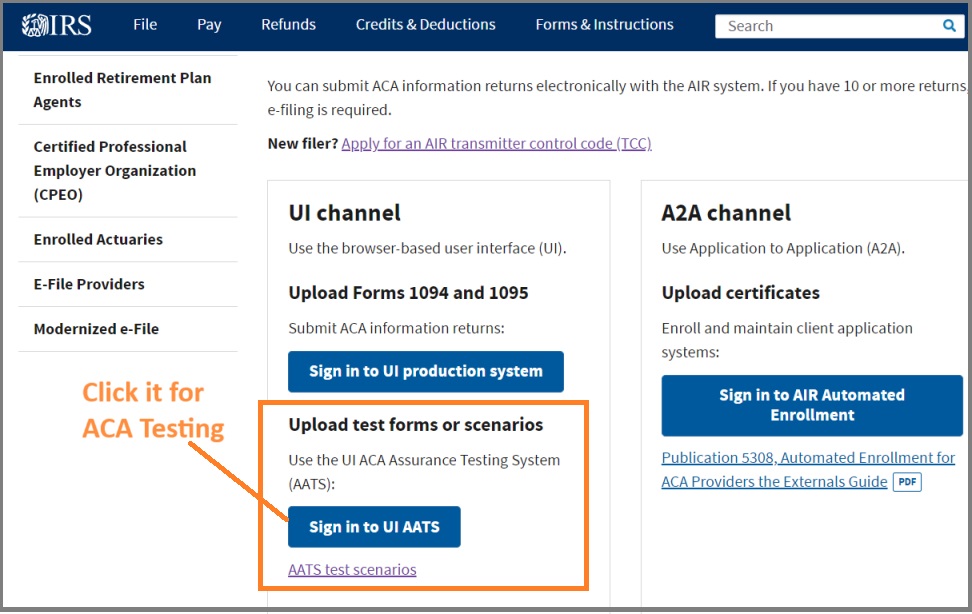

IRS Upload Site Link

https://www.irs.gov/e-file-providers/affordable-care-act-information-returns-air

On the IRS AIR Program screen, click the "User Interface (UI) ACA Assurance Testing System (AATS)" to access the testing site.

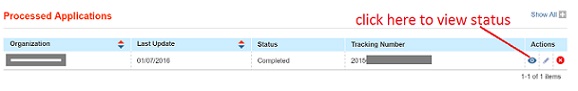

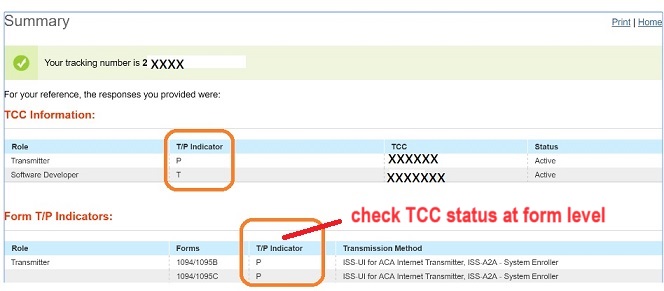

After uploading the files, login

IRS ACA UI channel to check the status by inputing TCC and the Receipt ID.

If the status is "Accepted", you can call the IRS at 1-866-937-4130 to change the status to "Production". If they don't give you a call back in 48 hours. Please contact them again.