Step 1: Prepare Form 941

ezPaycheck payroll software automatically generates Form 941 based on your payroll data. If you need to create Form 941 manually, please follow this guide for step-by-step instructions on manual 941 form generation.

1.1 Start ezPaycheck, click the left menu "Forms and Reports" then "Forms" to view the form options.

1.2 Select the 941 Form

The 941 form screen will open in ezPaycheck. Please ensure you select the appropriate Tax Year and Quarter to generate the form. You may add additional information if needed (e.g., Line 13 deposit).

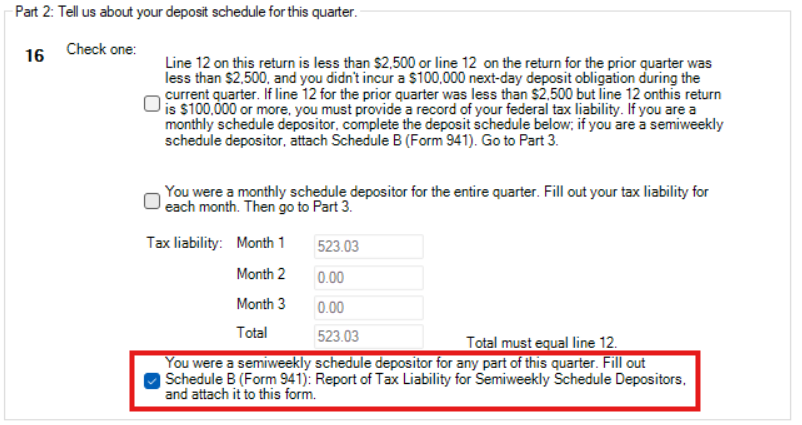

If you are a biweekly schedule depositor, you must include a Schedule B attachment with your 941 form. While preparing your 941 form, go to Part II and select the third option to include Schedule B in your eFile submission.

1.1.3 Review the 941 Form for Accuracy

Before you submit the 941 form, you will need to review the form for accuracy. This includes verifying that all the information on the form is correct, that all the numbers are correct, and that all the information is up to date. Pay special attention to all green boxes. These are the boxes that need to be filled out if your company requires it. Also double check that the year and quarter is correct.

If you paid any surplus taxes the previous quarter, you will need to manually enter those taxes into the 941 form. Please double-check that all the information is correct before proceeding.

Learn more information here on how to fill out the form 941, IRS 941 deposit and 941 troubleshooting.

Video Tutorial

If you prefer a video tutorial, you can watch our video tutorial on how to set up e-filing in ezPaycheck.