4. The Estmated FUTA Amount in Reports Can Be Different From Final Data on Form 940

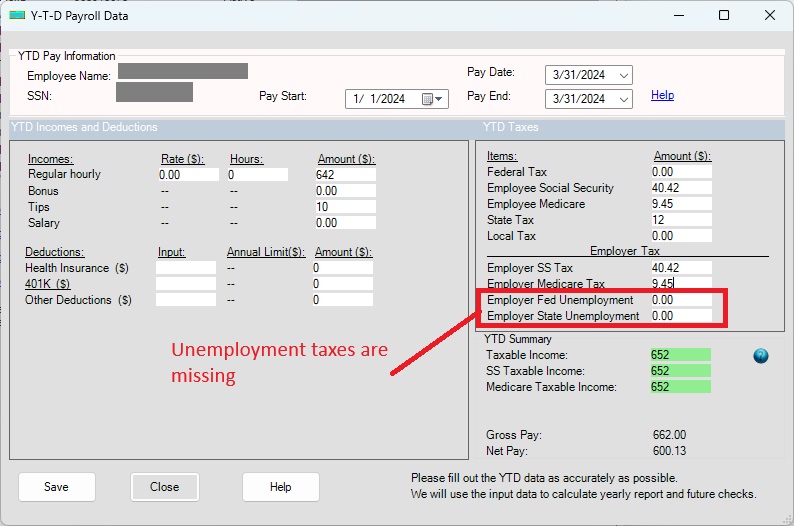

4.1. The default FUTA tax rate for 2025 is 6%. However, many companies can take up to 5.4% credit, effectively reducing the rate to 0.6%. Note that FUTA tax applies only to the first $7,000 of each employee's annual wages. How to Set up FUTA and SUTA 4.2. ezPaycheck estimates the FUTA tax based on your settings.

FUTA is employer-side tax. These estimated amounts are provided to help employers anticipate how much they might need to pay by year-end.

4.3. The IRS publishes the official FUTA rate at the end of each year.

The amounts on Form 940 may differ from the estimates due to adjustments in the actual FUTA rates or credit reductions.

Examples:

1) If the default 6% rate is used for FUTA estimation, the actual amount on Form 940 may be lower if the effective FUTA rate is reduced to 0.6%.

2) If a 0.6% rate is used for estimation and your state is subject to a higher Federal Unemployment Tax Act (FUTA) rate due to credit reductions, the amount on Form 940 will be higher.

For more details, refer to IRS 940 guide: https://www.irs.gov/pub/irs-pdf/i940.pdf

4.4. When making FUTA deposits, always use the final amount indicated on your Form 940..