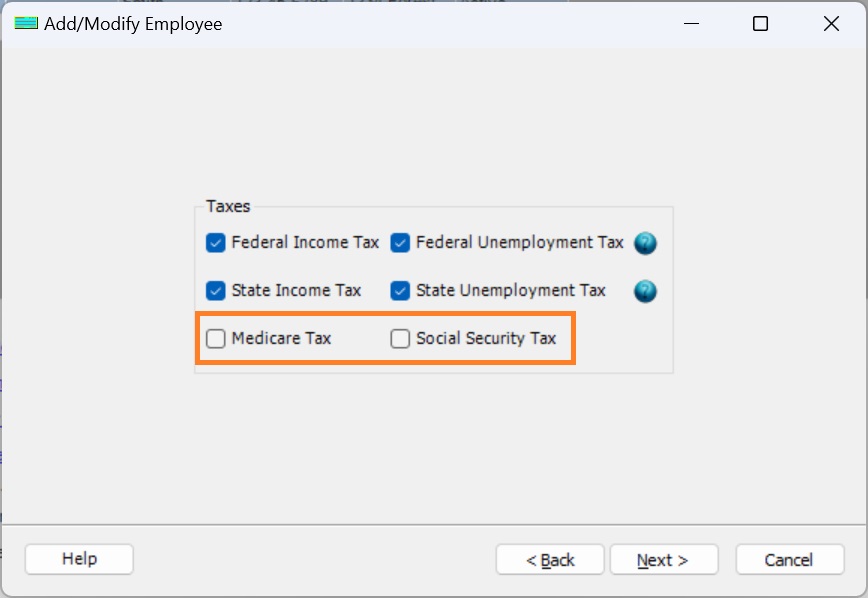

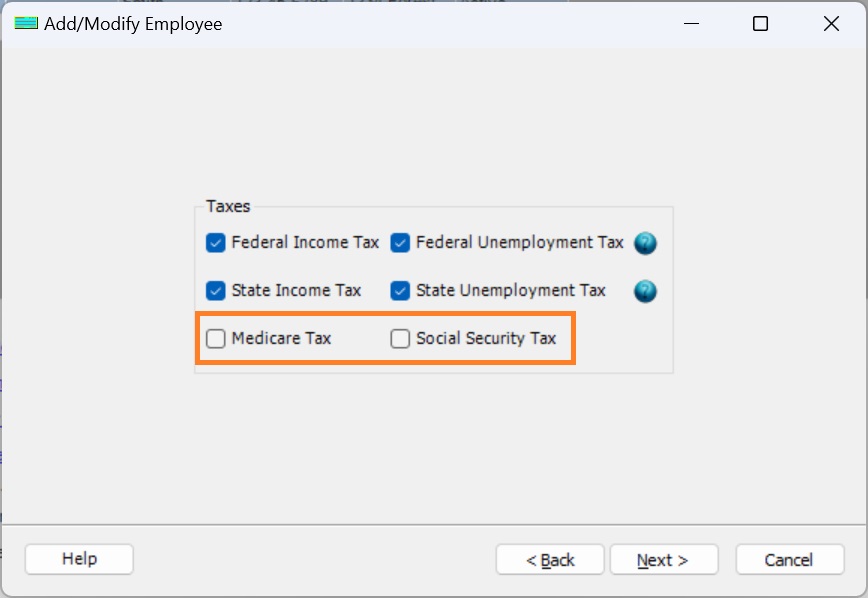

2. Edit the tax option

2.1 Click the next button until you see taxes screen

2.2 Edit tax options.

For example: For nonprofits and churches that do not need to deduct FICA taxes for clergy members and some employees, you can uncheck Social Security tax and Medicare tax here.