ezPaycheck: how to import employees from QuickBooks IIF file

Step 1: Export employee list from Quickbooks Utility to IIF file

1.1 Select export list "File -> Utilities -> Export -> Lists to IIF Files" from the manu.

(Click image to enlarge)

1.2 Select Employee List

(Click image to enlarge)

1.3 Save to IIF file

(Click image to enlarge)

1.4 Edit IIF file with Notepad, and remove non-data lines

(Click image to enlarge)

Step 2: Clear employee list (Opional)

If you have test data, you can remove it before you import data.

2.1 Click the left menu "Employees" then "List Employee" to view employee list.

2.2 Delete employees.

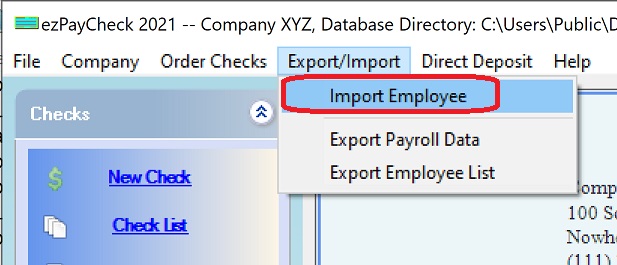

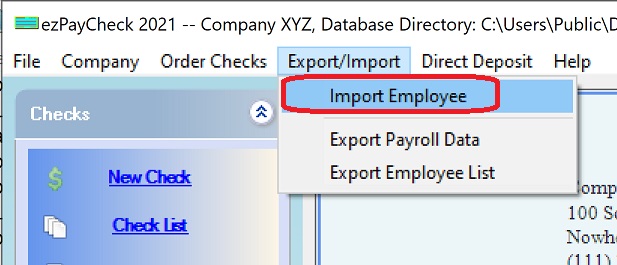

Step 3: ezPaycheck imports the employee list from .iif file

3.1 Click the top menu "Export/Import", then click "Import Employee"

3.2 Select the .csv file.

3.3 Map the fields.

3.4 Click the "Test Parse" button.

3.5 If there is no error, click the "Import" button to save data into database.

Step 4: Refresh Employee List, review and edit the employee tax options.

4.1 Click the left menu "Employees" then "List Employee" to view employee list.

4.2 Select the one employee from list, click "Edit xxxx Record" link to edit employee tax options.

Step 5: Process payroll

5.1 Follow

ezPaycheck Quick Start Guide to set up company, edit employees and print paychecks.

5.2 If you switch ezPaycheck in mid year, you can enter the YTD data easily.

How to enter the YTD data