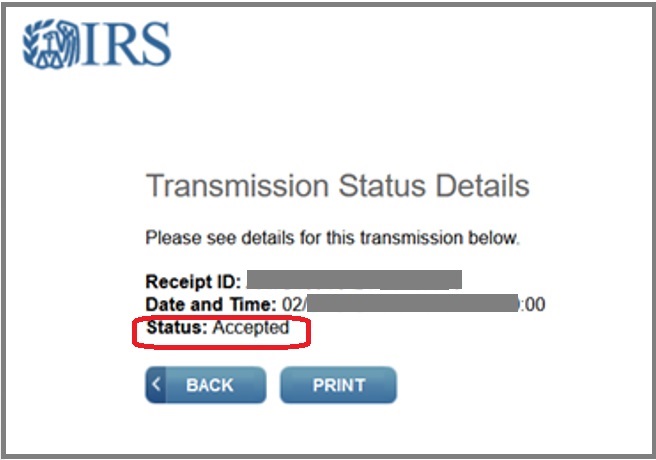

Step 2: Check If Your TCC Has Been Moved into Production

You can check the status from your e-Services Account.

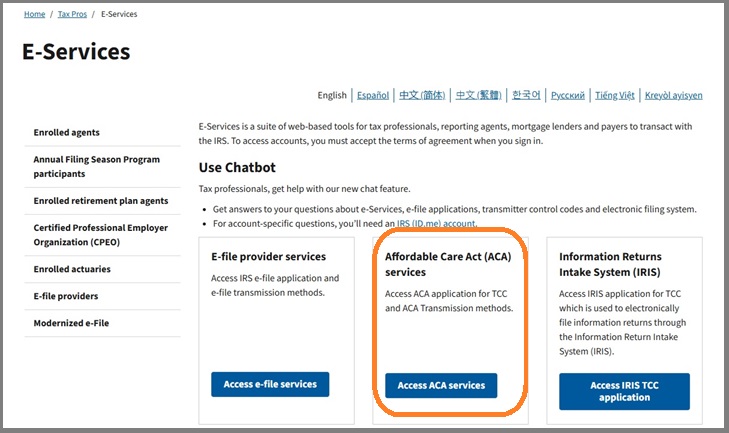

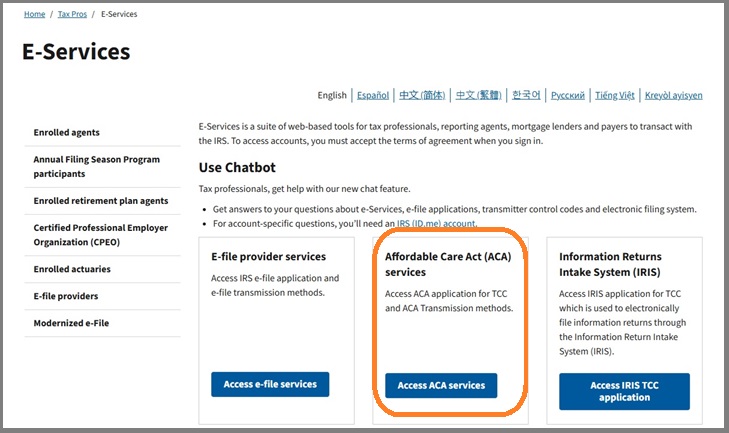

1. Click on the link to Access e-Services

https://www.irs.gov/e-services 2. Access ACA services

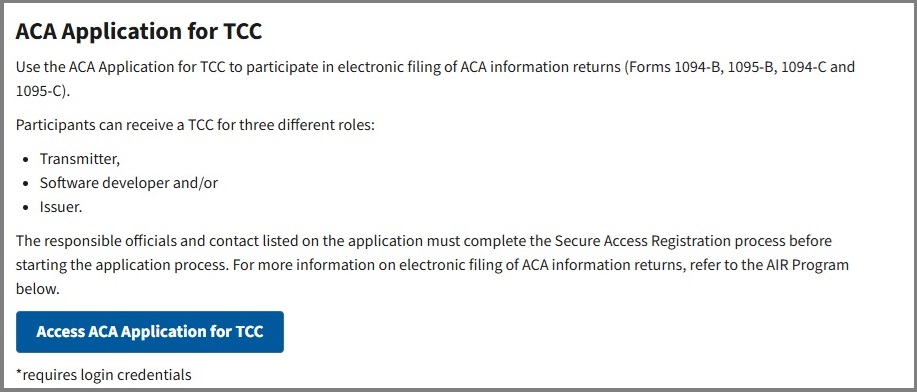

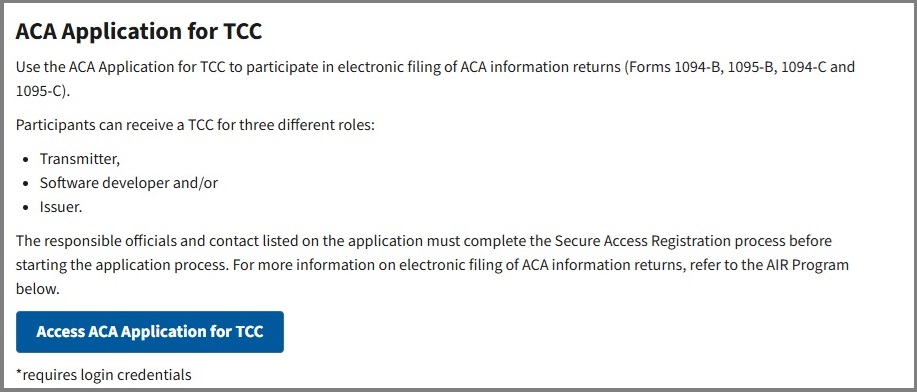

3. Click: ACA Application for TCC

4. Click: Login

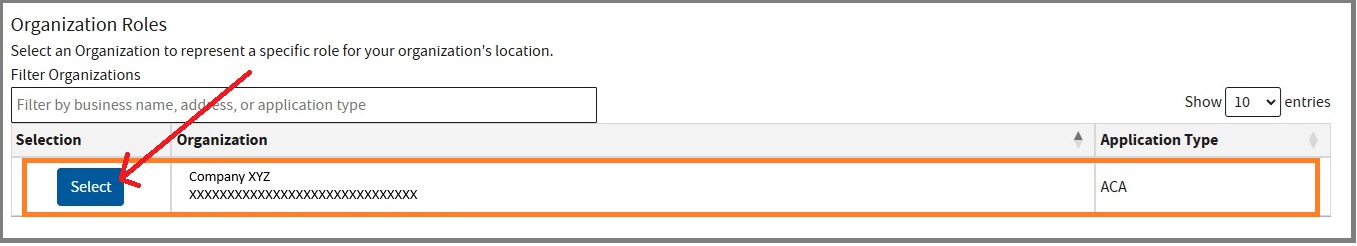

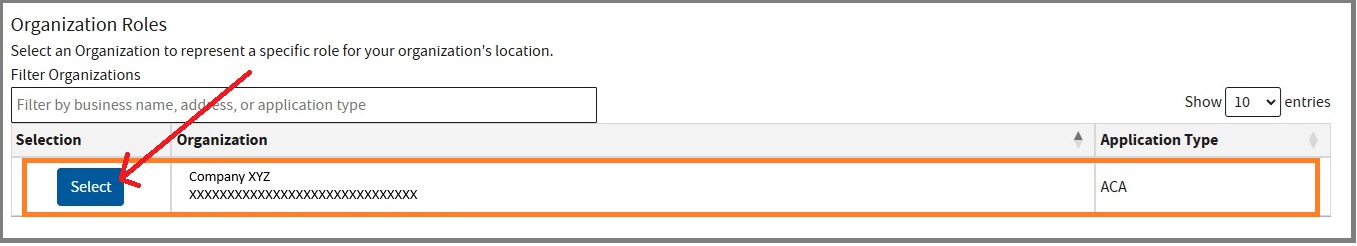

5. Select your company

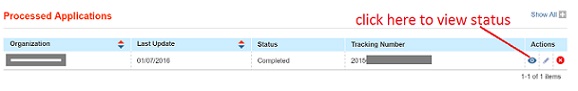

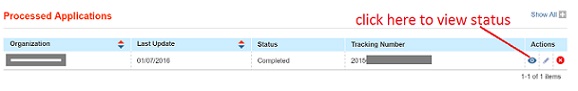

6. In the Applications section, click on the View Summary Page actions button. (It is the blue eye icon)

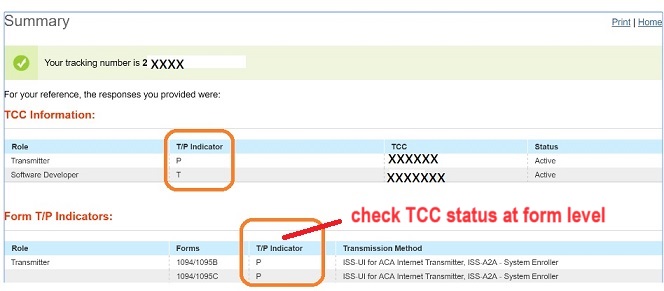

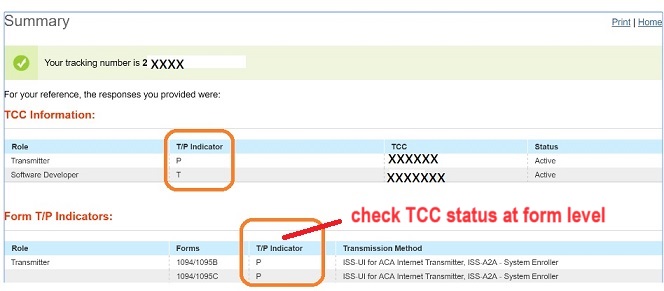

7. Check your TCC status at 1094/1095 form level

T = TEST

P = PRODUCTION

Call IRS at 1-866-937-4130 to change the status to "Production" after IRS accepted your testing efile and has not updated TCC status after 2 business days.

Call IRS at 1-866-937-4130 to change the status to "Production" after IRS accepted your testing efile and has not updated TCC status after 2 business days. If they don't give you call back in 48 hours. Please contact them again.

Note:

The Form Status Indicator for a Transmitter or Issuer will initially be set to Test "T" and once the required testing is

successfully completed, will be set to Production "P".

When the Form Status Indicator is set to Test "T", submissions can only be made to AATS. Once the

Form Status Indicator has been set to Production "P", submissions using that TCC may not be made to

AATS and can only be made to Production.