Step 1: Back up the ez1095 database file and the original XML files.

How to to back up ez1095 data

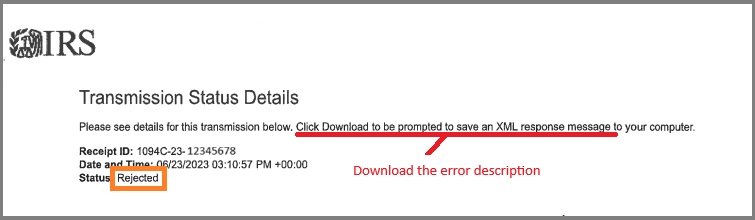

Step 2: Download the detailed error description from the IRS "Rejected" status message.

Step 3: Read the IRS XML error description and identify the forms with errors.

How to read IRS ACA form error description file

Common IRS Efile Errors and Solutions

Step 4: File either an original or a replacement submission with the IRS.

4.1. If you're unsure about the next submission, please contact the IRS office directly for guidance.

Replacement Submission:

A replacement is required when the entire submission is rejected due to issues like invalid XML formatting, outdated schemas, or technical errors in the file structure.

Resubmission:

A resubmission is needed when the entire submission is rejected due to critical errors such as an incorrect Employer Identification Number (EIN) or other significant data inaccuracies.

4.2. Do not directly edit the XML files. Instead, edit the 1095 Forms within ez1095, generate the new XML files, and submit them to the IRS.

4.3. If you originally submitted using another software, ez1095 can import 1095/1094 data from your previous XML e-file documents. You can then correct form errors, generate new XML documents, and submit them to the IRS.

How to efile 1095/1094 replacement