Step 2: Submit 1095-C Correction

2.1 Create a new file folder for 1095-C efile document

ie: you can add a folder under C driver

C:/1095C correction

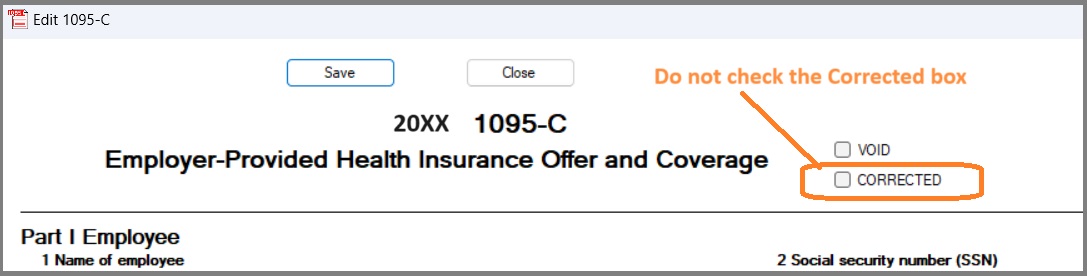

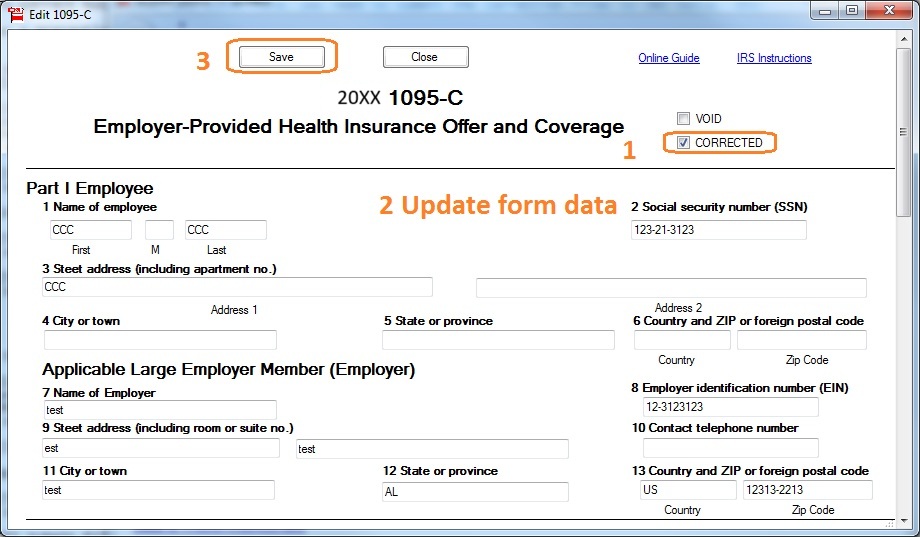

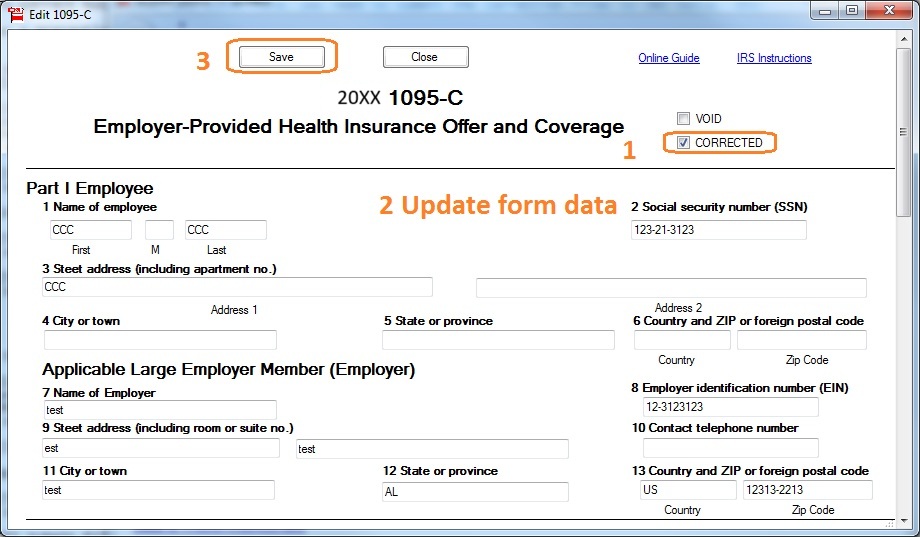

2.2 Fix the errors on 1095-C form(s).

- Open the 1095-C form that contains the error.

- Check the "CORRECTED" box at the top of the form.

- Make the necessary corrections.

- Click the "Save" button.

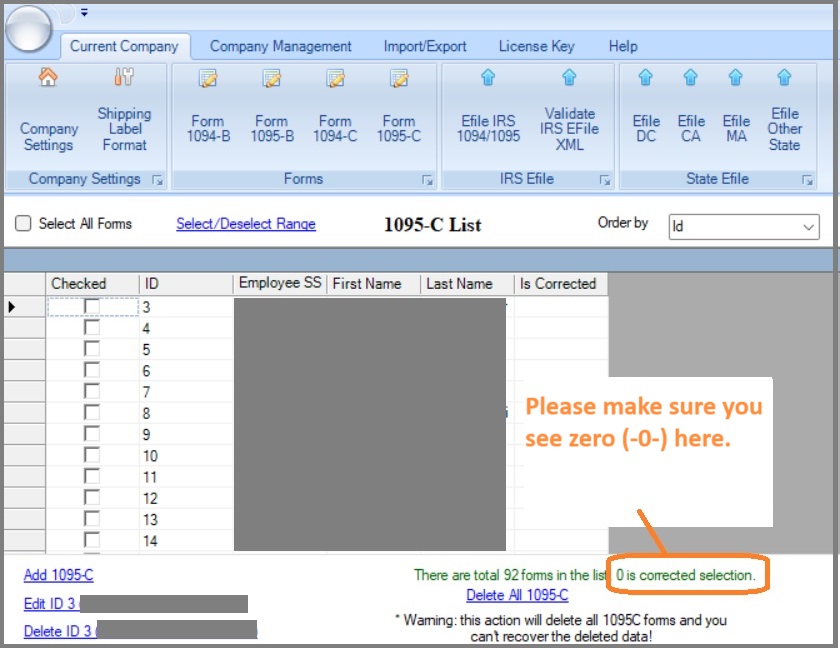

- Review the 1095-C form list

You can see how many forms are marked as

"CORRECTED" in the green summary bar located below the form list. This helps ensure only the intended forms are included in the correction submission.

2.3 Update the 1094-C form

When submitting corrected 1095-C forms, you must also include a 1094-C transmittal form.

2.3.1 Open the 1094-C form, but do not check the "CORRECTED" box.

2.3.2 In Line 18, enter the number of 1095-C forms you are correcting.

(Tip: This number should match the total shown in the green summary bar on the 1095-C list screen (see Step 2.2).

2.3.3 Leave all fields after Line 18 blank or unchecked.

IRS instructions, page 45 Forms 1095-C. File a separate submission with a Form 1094-C, without the correction indicator

checked. Only complete Form 1094-C through the element "Form1095CAttachedCnt" (Line 18), along

with corrections to any Forms 1095-Cs associated with the Applicable Large Employer (ALE). Please note:

The element "AuthoritativeTransmittalInd" (Line 19 and Parts II, III and IV of the Form 1094-C, should not

be completed.

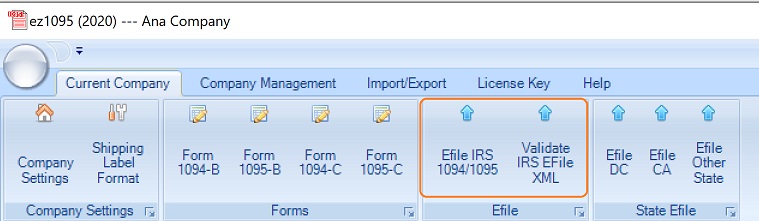

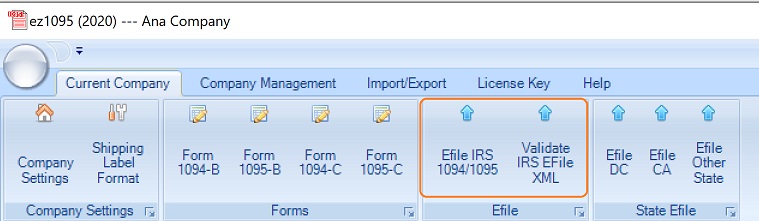

2.4: Submit the Correction File

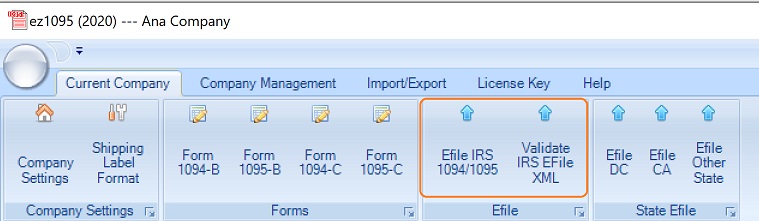

Click the top menu "File IRS 1094/1095" to open the eFile screen.

- Check the box labeled "Is Correction".

- Check the option "Efile 1095C Correction".

- Enter the Receipt ID of the submission you are correcting

- Change the file directory (Optional)

- Click "Save Data"

Option 1: Use ez1095 In-App eFiling Service

If you're using the built-in eFiling service within ez1095, simply click the "eFile with Halfpricesoft" button to submit your correction file directly.

Learn more at:

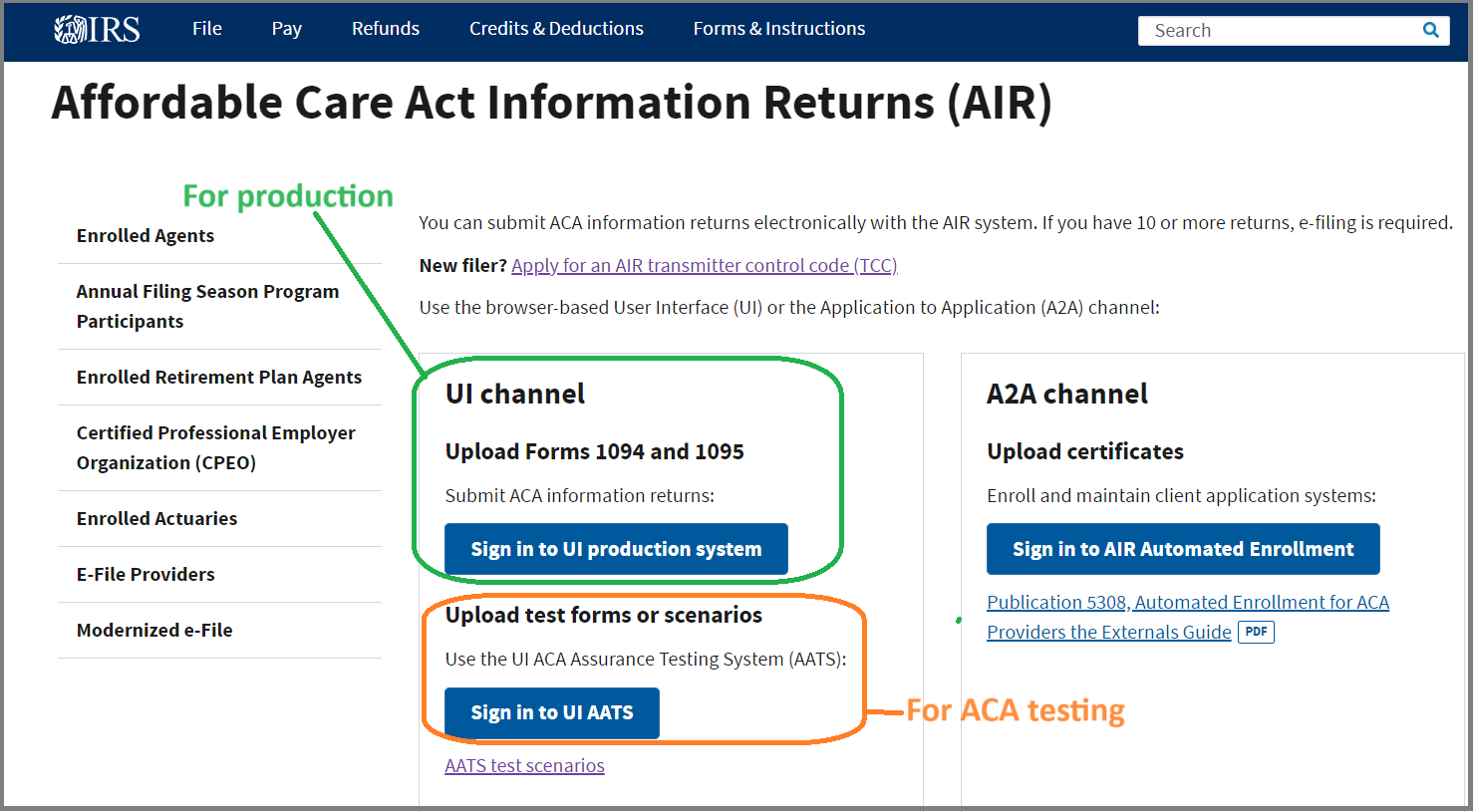

How to upload forms with ez1095 in-app service Option 2: Self-Filing Through IRS AIR Portal

If you are submitting the correction file with your own IRS account and TCC, follow the steps below:

2.4.1 Click the "Create File" button to generate the efile document

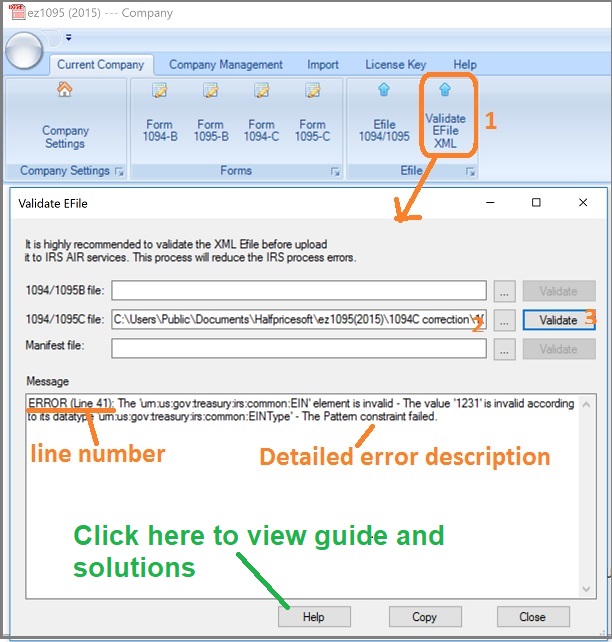

2.4.2 Validate XML files and submit files to IRS