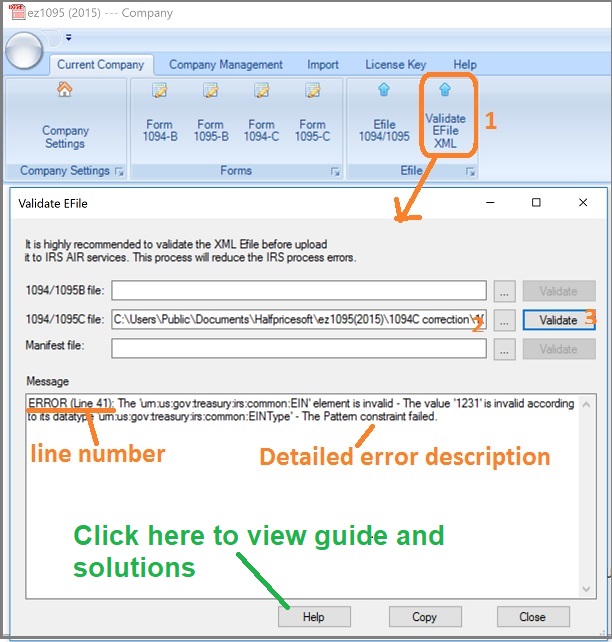

Step 3: Fix error(s) on 1095-C forms

If the IRS accepted your submission with errors, you only need to correct and re-file the specific forms that contain errors.

For example: If you originally filed 1000 forms and only 3 have errors, you only need to correct and resubmit those 3 forms.

Note: Do not remove any form from the 1095 list! Always update the forms directly within the ez1095 software.

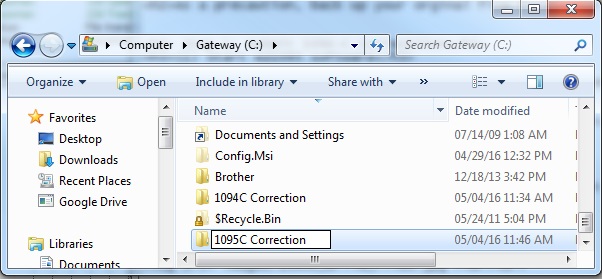

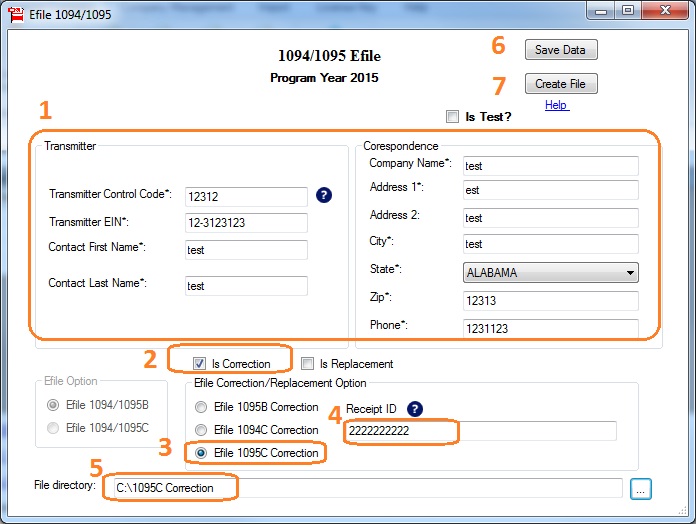

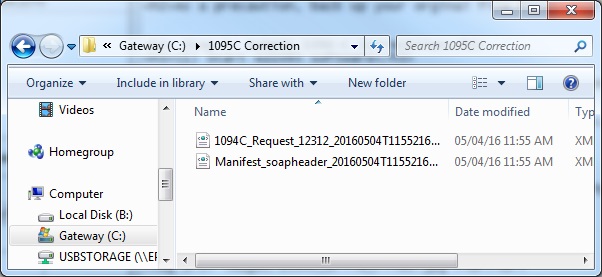

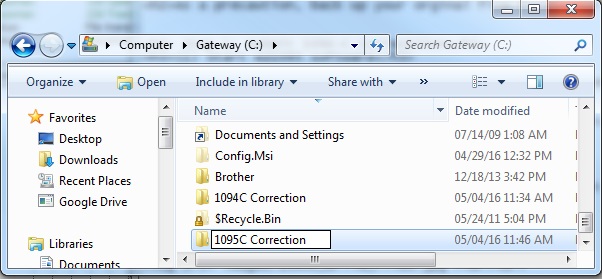

3.1 Create a new file folder for 1095-C efile document

ie: you can add a folder under C driver

C:/1095C correction

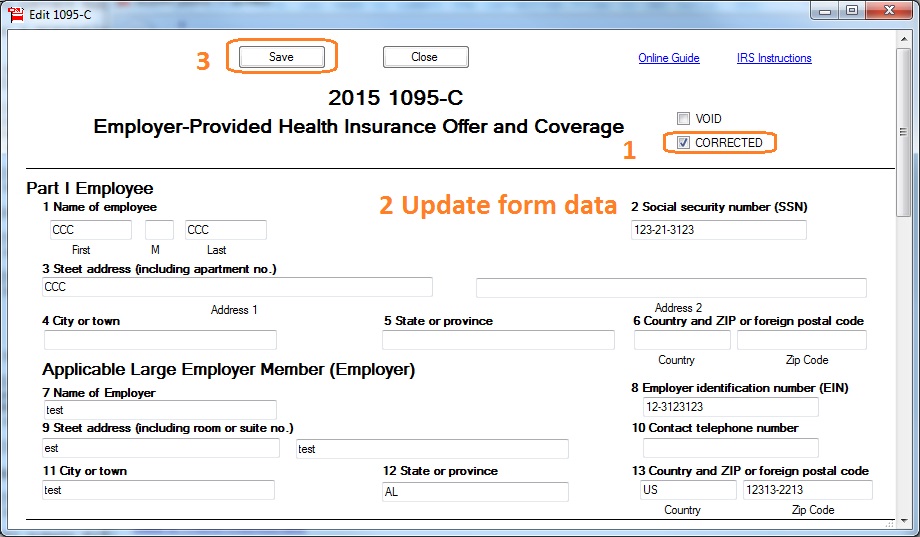

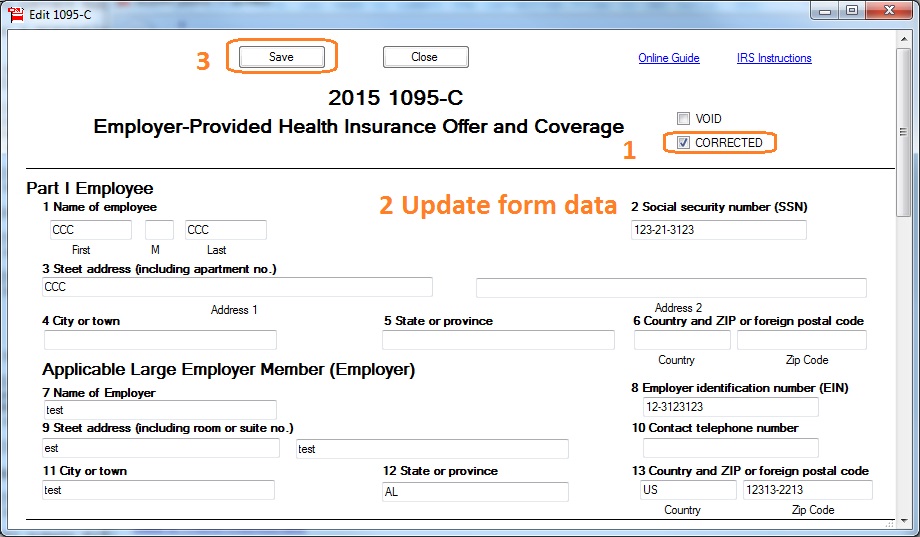

3.2 Fix the errors on 1095-C form(s).

- Open the 1095-C form that contains the error.

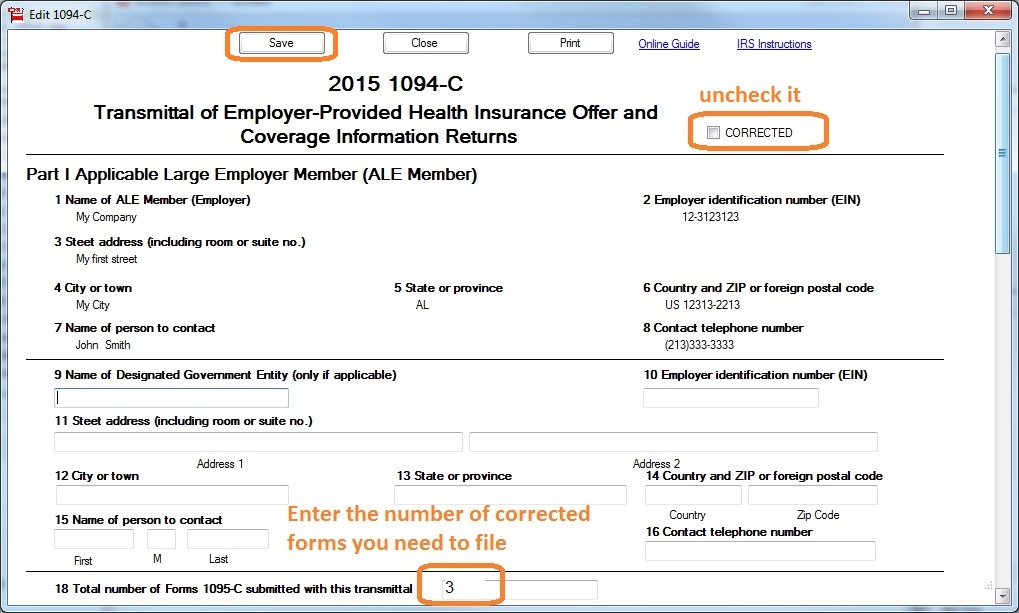

- Check the "CORRECTED" box at the top of the form.

- Make the necessary corrections.

- Click the "Save" button.

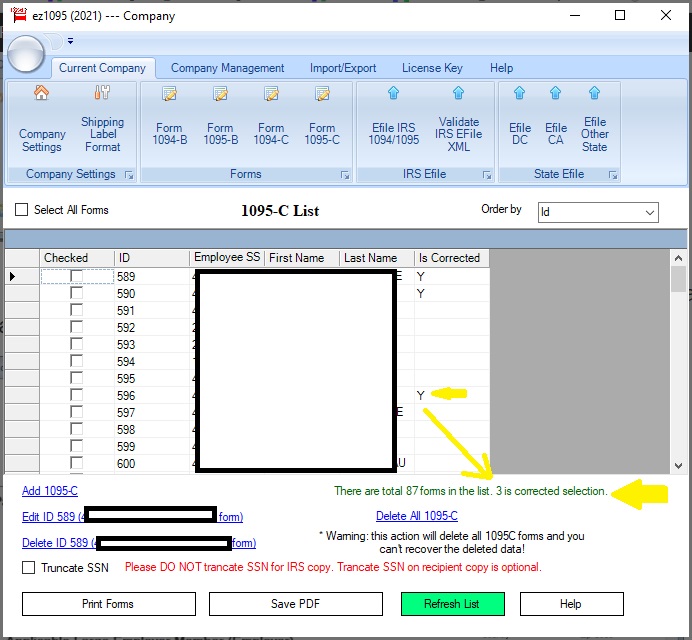

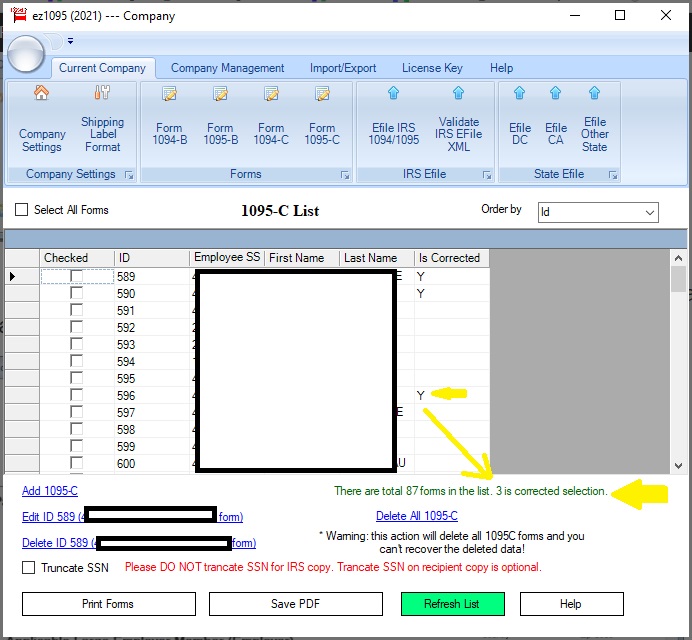

3.3 Review the 1095-C form list

You can see how many forms are marked as

"CORRECTED" in the green summary bar located below the form list. This helps ensure only the intended forms are included in the correction submission.